By Stephanie Meredith

September 21, 2020

The U.S. Mint produces more than 10 billion circulating coins a year. But it doesn’t distribute circulating coins to the public. The Mint relies on Federal Reserve Banks to put the coins into circulation. Learn about how pennies, nickels, dimes, and quarters enter circulation and reach your hands.

The U.S. Mint produces more than 10 billion circulating coins a year. But it doesn’t distribute circulating coins to the public. The Mint relies on Federal Reserve Banks to put the coins into circulation. Learn about how pennies, nickels, dimes, and quarters enter circulation and reach your hands.

The Mint is the issuing authority for coins. It sets the production numbers and makes the coins. Most circulating coinage is made at the Philadelphia and Denver Mint facilities.

The Federal Reserve is responsible for the country’s circulating coin inventory and distribution of coins to its depository institutions (banks, credit unions). Federal Reserve Banks buy coins from the Mint at face value.

The Mint and the Federal Reserve work together to get coins into circulation following the process below.

- Federal Reserve submits coin orders to the Mint.

The Federal Reserve comes up with a 12-month rolling forecast to guide the Mint. It also submits monthly coin orders. - Mint determines production numbers.

The Mint uses the forecast and coin orders to set the production numbers for each denomination. It also considers long-term demand by the public and seasonal trends that require more coins in circulation at certain times of the year, such as holidays. - Mint makes the coins.

The Mint makes the new pennies, nickels, dimes, and quarters for circulation. Learn about that process in part two of this series. - Mint transports the coins to the Federal Reserve Banks.

Armored cars and trucks take the coins from the Philadelphia or Denver Mint facilities to the Reserve Banks’ 28 branch offices and more than 100 private sector coin terminals. The coin terminals are operated by armored carrier services contracted by the Federal Reserve. - Federal Reserve Banks distribute to depository institutions.

The Reserve Banks’ depository institutions place orders for coins. The armored carriers transport the coins from the coin terminals to the depository institutions. - The coins enter circulation and cycle between banks, businesses, and people.

The depository institutions place the new coins in circulation by exchanging them with their customers, both businesses and individuals. They also give the coins to other banks that aren’t depository institutions with the Reserve Banks.

The new coins then become part of the circulation cycle.

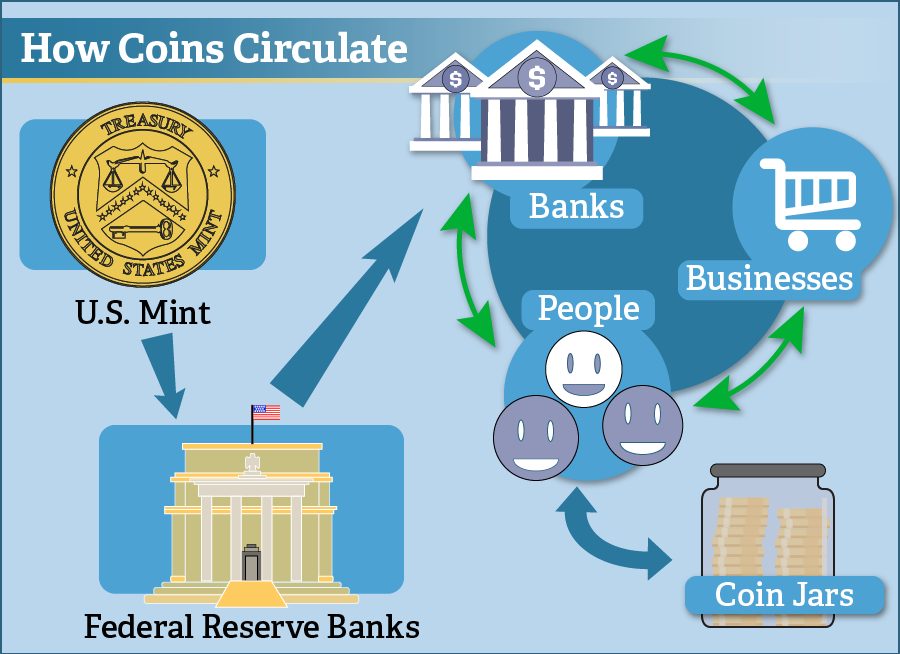

Coin Circulation Cycle

New coins account for less than 20 percent of the total coins in circulation. The rest are coins made in previous years that continue circulating. The average lifespan of a coin is about 30 years.

Coins circulate between banks, businesses, and people. Banks not only distribute new coins they receive from the Federal Reserve Banks, but also old coins. Banks can return excess coins to Reserve Banks, which re-distribute the coins to other banks and take worn coins out of circulation. Businesses deposit coins in banks and also receive coins. Coins are also exchanged between businesses and people.

When people keep coins to drop in change jars, piggy banks, or collections, they take the coins out of circulation. The coins return to circulation once people spend them or deposit them in banks or at coin exchange kiosks.

How Coins Are Made Series

- Part One: The Design and Selection Process

- Part Two: Coin Production Terminology

See more Inside the Mint articles.