In a conference report to Public Law 104-52 that created the United States Mint Public Enterprise Fund (PEF), Congress directed the United States Mint to report quarterly on implementation of the PEF. This report is designed to fulfill that requirement.

Contents

- Fourth Quarter Fiscal Year (FY) 2007 Financials:

- Year-to-Date Comparison: Year-to-date revenues for the fourth quarter FY 2007 were 14% higher than year-to-date revenues for the fourth quarter FY 2006.

- Third Quarter Comparison: Revenues for the fourth quarter of FY 2007 were 5% lower than revenues for the fourth quarter of FY 2006.

- Comparison to Previous Quarter: Revenues for the fourth quarter of FY 2007 were 8% lower than revenues for the third quarter of FY 2007.

- On August 15, 2007, the United States Mint introduced the third Presidential $1 Coin, the Thomas Jefferson Presidential $1 Coin. United States Mint Director Edmund C. Moy and Jefferson descendants hosted the launch and coin exchange at the Jefferson Memorial in Washington, DC.

- On August 30, 2007, the third coin in the First Spouse $10 Gold Coin Program, the Thomas Jefferson Liberty Gold Coin, was introduced.

- The Idaho commemorative quarter-dollar coin was introduced on August 3, 2007, and the Wyoming commemorative quarter-dollar coin was introduced on September 14, 2007.

- On July 17, 2007, the Congressional Gold Medal was awarded to Dr. Norman E. Borlaug.

Other Highlights

On July 3, 2007, the Secretary of the Treasury approved the final designs for the Dalai Lama Congressional Gold Medal.

State of the United States Mint

The United States Mint’s primary responsibilities are:

- Producing an adequate volume of circulating coins for the United States to conduct its trade and commerce, and distributing these circulating coins to the Federal Reserve Bank;

- Striking national medals, including Congressional Gold Medals;

- Manufacturing, marketing and selling proof and uncirculated coins, commemorative coins and medals to the general public. These products are known as numismatic products. Their value generally depends on factors such as mintage, rarity, condition and age;

- Manufacturing, marketing and selling gold, silver and platinum bullion coins through the American Eagle and the American Buffalo Bullion Programs. The value of these bullion coins generally depends on their weight in specific precious metals. These products are not sold directly to the general public by the United States Mint. They are sold to Authorized Purchasers and are available to the general public through precious metal dealers, coin dealers, brokerage companies and participating banks;

- Safeguarding United States Mint assets and non-Mint assets that are in the United States Mint’s custody, including bullion reserves at the Fort Knox Bullion Depository.

Status of the Public Enterprise Fund

The United States Mint’s Public Enterprise Fund is financed by the sale of circulating coins to the Federal Reserve and the sale of numismatic and bullion coins and other products to customers worldwide.

Year-to-Date Comparison

Table #1

Comparison of Year-to-Date Revenues for 4th Quarter 2007 to 4th Quarter 2006

(Millions of Dollars)

| Product Category | Year-to-Date through 4th Qtr FY 2007 | Year-to-Date through 4th Qtr FY 2006 | Change |

|---|---|---|---|

| Circulating | $1728 | $1272 | +36% |

| Numismatic | $563 | $524 | +7% |

| Bullion* | $356 | $536 | -34% |

| Total | $2647 | $2332 | +14% |

*Investment versions; proof versions are included in numismatic sales.

Year-to-Date Circulating Collections: Year-to-date circulating collections through the fourth quarter of FY 2007 totaled $1728 million – up by 36% from the same period of FY 2006. (See Table #1) This increase is attributable, in large part, to the continued increase in orders from the Federal Reserve Bank resulting from the introduction of the Presidential $1 Coin.

The United States Mint’s circulating collections fluctuate because of variations in the United States economy and change demand for circulating coins by commercial establishments and the general public. To accommodate such demand changes, the United States Mint and the Federal Reserve Bank continually assess their inventories and the demand for circulating coins, and then adjust their production, ordering and delivery schedules accordingly.

Year-to-Date Numismatic Revenues: Year-to-date numismatic revenues through the fourth quarter of FY 2007 totaled $563 million – up by 7% from the same period of FY 2006. (See Table #1) This resulted from an increase in the number of non-bullion products sold, including new products that were not available in FY 2006, such as the Presidential $1 Coin Proof Set™ and First Spouse Gold Coins.

Year-to-Date Bullion Revenues: Year-to-date bullion revenues through the fourth quarter of FY 2007 totaled $356 million – down by 34% from the same period of FY 2006. (See Table #1) This decrease was attributed to an overall reduction in bullion sales because of high precious metals prices.

Fourth Quarter Comparison: FY 2007 to FY 2006

Table #2

Comparison of 4th Quarter FY 2007 Revenues to 4th Quarter FY 2006 Revenues

(Millions of Dollars)

| Product Category | 4th Qtr FY 2007 | 4th Qtr FY 2006 | Change |

|---|---|---|---|

| Circulating | $391 | $304 | +29% |

| Numismatic | $179 | $237 | -24% |

| Bullion* | $84 | $147 | -43% |

| Total | $654 | $688 | -5% |

*Investment versions; proof versions are included in numismatic sales.

Circulating Fourth Quarter Comparison: Circulating collections for the fourth quarter of FY 2007 totaled $391 million – up by 29% from the same quarter of FY 2006. (See Table #2) This increase reflected the Federal Reserve Bank’s coin order for the new Presidential $1 Coin. Overall Federal Reserve coin orders were down from the same period in FY 2006 by 14% because of increased Federal Reserve inventory and decreased demand.

Numismatic Fiscal Year Comparison: Numismatic revenues for the fourth quarter of FY 2007 totaled $179 million – down by 24% from the same quarter of FY 2006. (See Table #2) This revenue decrease resulted from the decline in the number of American Buffalo Gold Proof Coins sold in FY 2007, which was in its second year of issue. Normally, a coin achieves the highest sales in the first year of issue. American Eagle Proof and Uncirculated Coins did increase compared to FY 2006’s fourth quarter.

Bullion Fiscal Year Comparison: Bullion revenues for the fourth quarter of FY 2007 totaled $84 million – down by 43% from the same quarter of FY 2006. (See Table #2) This decrease was attributed to high precious metals prices, as well as the expected decline in sales for the American Buffalo Program, introduced in 2006.

Comparison to Previous Quarter

Table #3

Comparison of 4th Quarter FY 2007 Revenues to 3rd Quarter FY 2007 Revenues

(Millions of Dollars)

| Product Category | 4th Qtr FY 2007 | 3rd Qtr FY 2007 | Change |

|---|---|---|---|

| Circulating | $391 | $552 | -29% |

| Numismatic | $179 | $104 | +72% |

| Bullion* | $84 | $50 | +68% |

| Total | $654 | $706 | -7% |

*Investment versions; proof versions are included in numismatic sales.

Quarterly Circulating Comparison: Circulating collections for the fourth quarter of FY 2007 totaled $391 million – down by 29% from the third quarter of FY 2007. (See Table #3) This collection’s decrease is consistent with the United States Mint’s shipment of 3.2 billion coins to the Federal Reserve Bank during the fourth quarter of FY 2007 – down by 36% from the five billion coins shipped during the third quarter of FY 2007.

Projected Fourth Quarter 2007 Circulating Collections: Circulating collections are expected to decrease next quarter in concert with a decrease of the Federal Reserve’s forecasted coin order to 2.3 billion coins. This is attributable to higher than normal seasonal increases to Federal Reserve inventory during the fourth quarter of 2007 and a plan to reduce total operating inventory levels across the Federal Reserve system

Quarterly Numismatic Comparison: Numismatic revenues for the third quarter of FY 2007 totaled $104 million — down by 10% from the second quarter of FY 2007. (See Table #3) This slight revenue decrease resulted from the later than expected release of some 2007-dated products.

Projected First Quarter Numismatic Revenues: Next quarter’s revenues are expected to increase because the 2007 United States Mint Gift Catalog will be mailed this quarter. This catalog includes the majority of the United States Mint’s products, including the American Legacy Collection. In December, another brochure highlighting five new Presidential $1 Coin products will be mailed.

Quarterly Bullion Comparison: Bullion revenues for the fourth quarter of FY 2007 totaled $84 million – up by 68% from the third quarter of FY 2007. (See Table #3) This revenue increase was a result of the seasonal demand for bullion coins.

Projected First Quarter 2008 Bullion Revenues: Bullion revenues are expected to remain comparable to this quarter’s revenue.

Update on Activities

50 State Quarters Program

Idaho Quarter

United States Mint Director, Edmund C. Moy, joined Secretary of the Treasury Henry M. Paulson Jr.: Secretary of the Interior Dirk Kempthorne; and Idaho State Treasurer Ron G. Crane to launch the Idaho commemorative quarter-dollar in a ceremony on August 3, 2007, at the Boise Depot in Boise, Idaho. Larry Gebert, Anchor of KTVB-NBC News, served as the Master of Ceremonies.

The Idaho quarter was the third quarter of 2007, and the 43rd to be introduced in the United States Mint’s 50 State Quarters Program. The reverse of the Idaho quarter features the Peregrine Falcon imposing its presence above an outline of the State of Idaho. The coin bears the inscriptions “Esto Perpetua” (the State motto meaning “May it be Forever”), “Idaho,” “1890,” and “2007.”

Wyoming Quarter Launch

Director Moy joined Wyoming Governor David D. Freudenthal to launch the Wyoming commemorative quarter-dollar in a ceremony on September 14, 2007, at the Cheyenne Civic Center in Cheyenne, Wyoming. Pete Williams, NBC News Correspondent, served as the Master of Ceremonies for the event.

The Wyoming quarter was the fourth quarter of 2007, and the 44th to be introduced in the United States Mint’s 50 State Quarters Program. The reverse of the Wyoming quarter features a bucking horse and rider with the inscriptions “The Equality State,” “Wyoming,” “1890,” and “2007.”

Presidential $1 Coin Act of 2005

Thomas Jefferson Presidential $1 Coin Launch

The Thomas Jefferson Presidential $1 Coin launch and coin exchange was held at the Jefferson Memorial in Washington, D.C., onAugust 15, 2007. This is the third release in the Presidential $1 Coin Program. The launch featured Thomas Jefferson re-enactors and the release of the results of a national survey commissioned by the United States Mint to test citizens’ knowledge of American Presidents. Children in the crowd were given Thomas Jefferson Presidential $1 Coins, and a coin exchange allowed members of the public to receive the Thomas Jefferson Presidential $1 Coins one day before they went into general circulation.

Presidential $1 Coin Outreach

The United States Mint kicked off the fourth quarter of FY 2007 with a coin users group forum on July 12, 2007, hosted jointly by the United States Mint and the Federal Reserve Bank. Attendees included representatives from Federal entities; transit authorities; retail, vending, coin equipment, banking and armored carrier industries; and the Presidential $1 Coin Coalition. The forum provided interaction with attendees through Question and Answer sessions, presentations and panel discussions. Feedback and suggestions from attendees were compiled and documented, and this information will assist the United States Mint and Federal Reserve Bank to continue to break down barriers to the robust circulation of $1 coins.

During the fourth quarter, the United States Mint commissioned the services of the Gallup Organization to determine the level of the public’s knowledge about the Presidents through the use of a nationwide survey. This information was then used to stimulate interest in the release and use of the Thomas Jefferson Presidential $1 Coin.

The ceremonial launch of the Thomas Jefferson $1 Coin took place on August 15, 2007, with a press conference and coin exchange at the Jefferson Memorial in Washington D.C. The United States Mint reached a major milestone of approximately one billion audience impressions from the year’s outreach initiatives.

United States Mint and Federal Reserve Bank representatives delivered a presentation to members of the American Military Bankers Association (AMBA) at its annual fall workshop on September 18, 2007. This joint presentation clarified the intent of the Presidential $1 Coin Act of 2005 (Act) and allowed members of the AMBA to ask questions about their responsibilities in meeting the mandates of the Act.

First Spouse 24-Karat Gold Coins

The United States Mint, through the authorization granted in the Act, is honoring our Nation’s First Spouses by issuing one-half ounce, 24-karat gold proof and uncirculated coins featuring their images in the order that they served as First Spouse. The Act contains a provision to provide continuity of the First Spouse Gold Coin Program during those times in which a President served without a First Spouse. This provision applies to Thomas Jefferson, whose wife Martha died in 1782. The gold coins issued to accompany any President who served without a spouse feature an obverse design emblematic of Liberty as depicted on a United States coin originally issued during the President’s time in office. For Thomas Jefferson’s Presidency, the selected image appeared on the Draped Bust Half-Cent coin from 1800-1808.

The Thomas Jefferson’s Liberty Gold Coins were released on August 30, 2007, reaching their maximum mintage numbers on the first day of issue, 40,000 total coins. The Dolley Madison Gold Coin, the last in the series for calendar year 2007, will be released in late November.

First Spouse Design Process

After the design narratives were reviewed by the Citizens Coin Advisory Committee (CCAC) in August, the United States Mint consulted with national scholars and historians to review the design narratives for the five First Spouses to be honored in 2009 – Anna Harrison, Letitia Tyler, Julia Tyler, Sarah Polk, and Margaret Taylor. The design development will continue according to schedule.

American Buffalo 24-Karat Gold Coins

This quarter, 27,000 ounces of American Buffalo 24-Karat Gold Bullion Coins and approximately 38,500 American Buffalo 24-Karat Gold Proof Coins were sold.

Artistic Infusion Program

In July and August, the Artistic Infusion Program (AIP) artists were assigned to develop the obverse and reverse designs for the 2009 Lincoln Commemorative Coin Program and the 2009 Louis Braille – Braille Literacy Commemorative Coin Program.

United States Mint Educational Initiative (MEI)

Educational content was added to the H.I.P. Pocket Change™ website, including the Time Machine. The interactive cartoon was updated with a trip to the World War II era. The summer edition of the quarterly online newsletter, Making Cents, was added, and the “State Quarter Day in the Classroom” page featured Idaho in July and Wyoming in September.

Features on Independence Day and back to school were created. The “Coin of the Month” section featured the Idaho commemorative quarter-dollar coin in July, the Thomas Jefferson Presidential $1 Coin in August, and the Wyoming commemorative quarter-dollar coin in September.

The H.I.P. Pocket Change™ website had over 925,000 visits during the quarter, an increase of 39% over the same quarter last year. In addition, 11,290 Presidential $1 Coin lesson plans, 25,424 Westward Journey Nickel Series lesson plans, and over 329,000 50 State Quarters lesson plans were downloaded during this quarter, a 78% increase over the same quarter last year.

The United States Mint Educational Initiative team staffed a booth at the American Federation of Teachers conference in Washington, D.C., in July. The conference attracted more than 3,000 educators. More than 200 educators signed up for the Teachers’ Network.

Licensing and Licensing Agreements

The United States Mint Office of Licensing continues to maintain licensing agreements with three licensees. These licensees manufacture and market a variety of “Official United States Mint Licensed Products” through various channels. The licensees are as follows:

- Whitman Publishing

- Peak Capital Group, LLC

- Hallmark Group, Ltd.

During the fourth quarter of FY 07, the United States Mint’s licensing activities have earned royalties of approximately $55,567 and $282,800 in coin sales.

Partnerships

There was no new partnership activity during the quarter.

Other Highlights

Commemorative Coin Programs

Numismatic and Circulating

American Bald Eagle Recovery and National Emblem Commemorative Coin Program Design Process

The Secretary of the Treasury approved the final designs for the 2008 American Bald Eagle Recovery and National Emblem Commemorative Coin on July 3, 2007. This is a three-coin program, including a $5 gold coin, a silver dollar, and a clad half-dollar. Currently, this is the only program scheduled for 2008.

Abraham Lincoln Bicentennial One-Cent Coin Redesign

In July and August, the Abraham Lincoln Bicentennial Commission reviewed the design candidates for the four reverse designs representing the four aspects of Abraham Lincoln’s life. After the designs were revised, the design candidates were presented to the Federal advisory bodies at their scheduled meetings in September.

Abraham Lincoln Commemorative Coin Program Design Process

The design candidates for the silver dollar commemorating the presidency of Abraham Lincoln were developed in July-August and are scheduled to be reviewed by the Abraham Lincoln Bicentennial Commission in early October.

Louis Braille Commemorative Coin Program Design Process

The designs for the silver dollar commemorating the bicentennial of the birth of Louis Braille and Braille Literacy efforts were assigned to the United States Mint Sculptor-Engravers and the AIP artists for development in early September. The design candidates are scheduled to be reviewed by the National Federation of the Blind in mid-October.

Native American $1 Coin Design Process

The design process for the Native American $1 Coin Program has been drafted and will be forwarded to the Secretary of the Treasury for approval.

Medals

Norman E. Borlaug Congressional Gold Medal Design Process

On July 17, the Congressional Gold Medal was awarded to Dr. Norman E. Borlaug. Bronze duplicates of the medals also went on sale to the public.

Dalai Lama Congressional Gold Medal Design Process

The Secretary of the Treasury approved the final designs for the Congressional Gold Medal honoring the 14th Dalai Lama of Tibet on July 3, 2007. The medal is scheduled to be awarded to the Dalai Lama on October 17, 2007.

Public Information Site

The United States Mint website had 9,467,100 visits during the fourth quarter, an increase of 59% over the same quarter last year. The average duration of a visit to the United States Mint website has gone up 201% in this quarter compared to the same quarter last year, from 4:49 minutes to 14:32 minutes. In addition, there was a 177% increase in the number of repeat visitors from 342,560 to 950,160. These major increases can be attributed to the ongoing updates to current content and the creation of new content and features to the website.

The three sections with the largest increase in visits in the fourth quarter FY 2007 compared to the fourth quarter FY 2006 were the:

- “Consumer Alerts” page (recently renamed from “Consumer Awareness”) with 63% more visits;

- “Coins and Medals” page (renamed from “Special Programs”) with a 43% increase in visits; and

- “Pressroom” page, with a 42% increase in visits.

Earlier this year, the United States Mint inserted hyperlinks that could take the site visitor directly to the catalog for specific products. This quarter alone, these hyperlinks were used more than 180,000 times to gain access to the United States Mint Online Catalog.

The United States Mint sent the Presidential $1 Coin e-newsletter to more than 80,000 subscribers, and sent the Coins Online e-newsletter monthly to its more than 400,000 subscribers. In addition, the Really Simple Syndication (RSS) feeds were the third most accessed section of the site. The United States Mint added Presidential $1 Coin News and Website Updates to the RSS feed list this quarter, as RSS feeds prove to be a major vehicle for dispensing information to our visitors and customers.

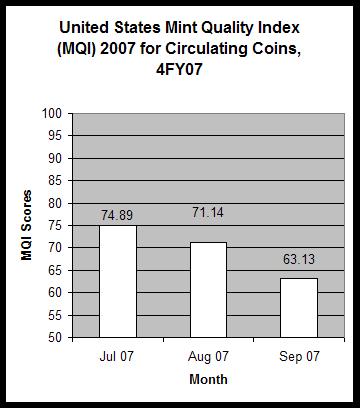

Quality

The United States Mint conducts periodic product quality audits at its manufacturing facilities with a cross- functional team composed of production, quality, and administrative personnel. A statistically significant sampling of coin products is evaluated and the number of ‘defects’ found is entered into a weighted index formula. The objective of the United States Mint Quality Index (MQI) is to measure relative quality levels and detect changes and trends in quality; it does not represent a ‘percent of good products.’ The MQI is a viable metric for continual quality improvement at the United States Mint. Opportunities for improvement have been identified.

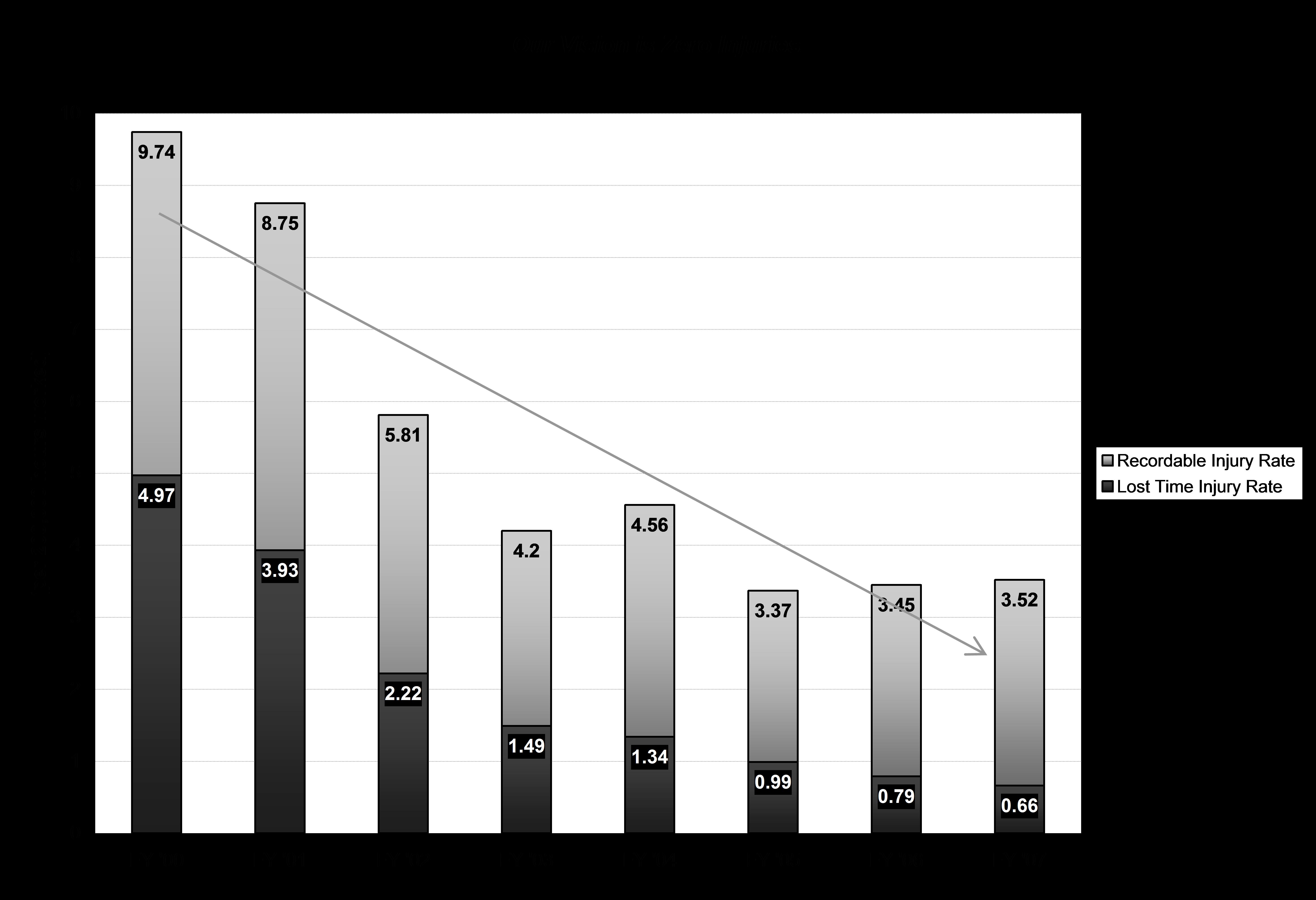

Safety

The two indicators used to measure safety are the Lost Time Injury and Illness Rate (work-related injuries resulting in time off from work) and the Recordable Injury Rate (injuries resulting in restricted work activity, medical treatment, and days away from work). In FY 2007, there were 16 lost time injuries, corresponding to a Lost Time Injury Rate of 0.88, which falls short of the strategic plan goal of 0.62. In FY 2007, there were 64 recordable injuries, resulting in a Recordable Injury Rate of 3.51, which is slightly higher than FY 2006. The United States Mint at West Point completed its second consecutive year without a lost time accident. In addition, two other sites experienced only one lost time injury during FY 2007. The United States Mint will intensify its efforts to resume the positive trend established over the past seven years, and will redouble efforts to decrease the number of injuries.

Audits and Reports

The Treasury Office of Inspector General (OIG) initiated a review of the Bureau of the Public Debt Administrative Resource Center’s (ARC) administration of the Workers’ Compensation Program on behalf of the United States Mint, Alcohol and Tobacco Tax and Trade Bureau, and the OIG. The review objective was to assess program effectiveness in monitoring employee worker’s compensation payments. Based on its preliminary work, which included contacting Treasury customers who used ARC services, the OIG has determined it will not continue with the workers’ compensation audit and has issued a memorandum of termination for this audit.

The OIG issued an engagement memorandum on September 17, 2007, announcing an audit of the United States Mint’s controls over production scheduling. The audit objective will be to examine how product demand is determined and how production is scheduled accordingly.