In the conference report to Public Law 104-52, enacted November 19, 1995, which created the United States Mint Public Enterprise Fund (PEF), Congress directed the Mint to report quarterly on implementation of the PEF. Since that time the Mint has reported on implementation and how it is using PEF flexibilities. This is the twenty-sixth quarterly report and includes content that is prospective as well as retrospective.

Contents

Summary

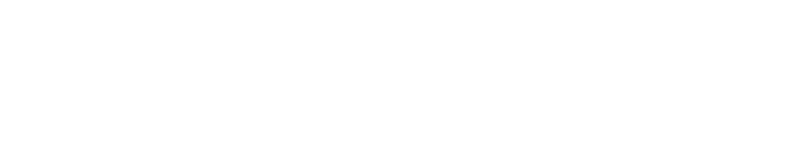

- Third quarter FY 2002 revenues: Circulating Coins: $376 million, which is a 29% increase from second quarter. Numismatic Products: $89 million, which is a 170% increase from second quarter. Bullion Coins: $23 million, which is a 55% decrease from second quarter.

- In the fourth quarter of FY 2002, revenue from circulating coins is expected to match or exceed third quarter revenues; revenue from numismatic products is expected to reach between $60 million and $65 million; and revenue from bullion coins is expected to increase to about $34 million.

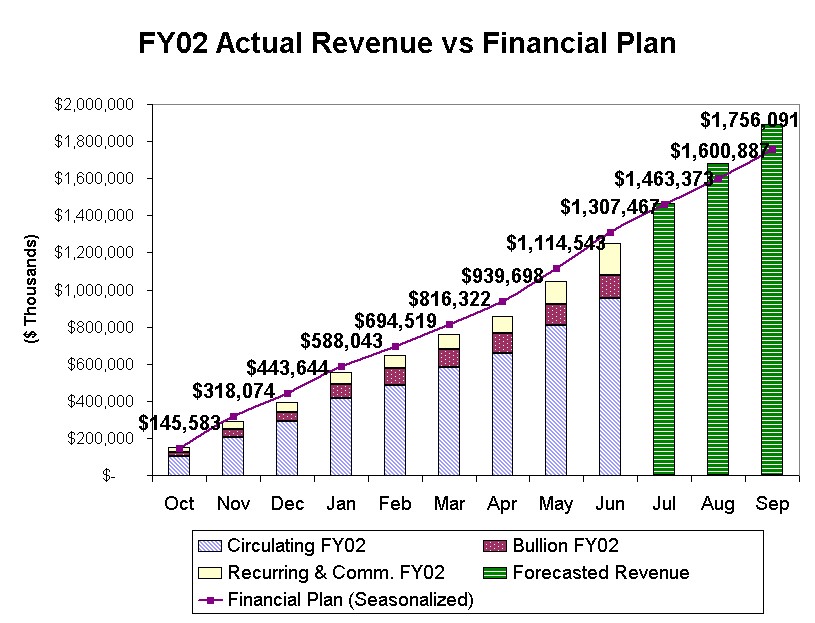

- The Mint-wide FY 2002 year-to-date Lost Time Accident rate is 2.1. This rate is higher than the second quarter rate of 1.8, but lower than the rate of 3.4 for the comparable period in FY 2001. In April, the Philadelphia Mint resumed operations after completing a top-to-bottom safety and housekeeping overhaul. (Operations there had been suspended in March because of safety and housekeeping concerns.)

- Production of Golden Dollars was suspended in May because existing supplies were sufficient to meet demand. The United States Mint is currently addressing barriers to Golden Dollar circulation through various strategies. Director Henrietta Holsman Fore testified before Congress about these strategies in May.

- The Office of Procurement is currently improving its business practices through a variety of activities.

- The United States Mint is considering a proposal for a four-year nickel redesign program commemorating the Lewis & Clark Expedition.

- Congress authorized purchases of silver on the open market to produce American Eagle Silver Bullion Coins. This authorization, which is awaiting the President’s signature, is essential for continued production of Silver Eagles.

- Other Highlights: Reagan medal awarded. Louisiana Quarter Launched. Euro coin set released. Mixed combined proof sets discontinued.

- Ahead: As an efficiency measure, the United States Mint’s Customer Care Center in Lanham, Maryland will close and functions currently handled there will be divided between a commercial customer call center in Plano, Texas and Mint Headquarters in Washington D.C. The Denver Mint will resume limited tours in July, and the Philadelphia Mint intends to do so in August. General Henry H. Shelton will receive a Congressional Gold Medal.

State of the Mint

The United States Mint’s main responsibilities are:

- Producing an adequate volume of circulating coins for the Nation to conduct its trade and commerce, and distributing

these coins to the Federal Reserve. - Manufacturing, marketing and selling proof and uncirculated coins, commemorative coins and medals to the general public. These products are known as numismatic items.

- Manufacturing, marketing and selling gold, silver and platinum bullion coins through the American Eagle Bullion Program. The value of American Eagle Bullion Coins generally depends upon their weight in specific precious metals. (By contrast, the numismatic value of other types of coins generally depends upon factors such as mintage, rarity, condition and age.) American Eagle Bullion Coins provide investors with a simple and tangible means to own precious metals. Not sold directly to the general public by the United States Mint, these products are available through precious metal dealers, coin dealers, brokerage companies and participating banks.

- Safeguarding United States Mint assets and non-Mint assets that are in the Mint’s custody, including bullion reserves at the Fort Knox Bullion Depository and elsewhere.

Status Of The Public Enterprise Fund

The United States Mint’s Public Enterprise Fund is financed by the sale of circulating coins to the Federal Reserve and the sale of numismatic and bullion coins and other products to customers worldwide.

Table #1

QUARTERLY COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2002 3rd Qtr | FY 2002 2nd Qtr | Change |

|---|---|---|---|

| Circulating | $376 | $291 | +29% |

| Numismatics | $89 | $33 | +170% |

| Bullion* | $23 | $51 | -55% |

| TOTAL | $488 | $375 | +30% |

Table #2

FISCAL YEAR COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2002 3rd Qtr | FY 2001 3rd Qtr | Change |

|---|---|---|---|

| Circulating | $376 | $477 | -21% |

| Numismatics | $89 | $92 | -3% |

| Bullion* | $23 | $23 | 0 |

| TOTAL | $488 | $592 | -17% |

* Investment versions, proof versions will be included in numismatic sales when offered.

Circulating Coins: The demand for circulating coins by commercial establishments and the general public fluctuates with the United States’ ever-changing economy. To accommodate this variability, the United States Mint and Federal Reserve continually assess their inventories and the demand for circulating coins, and adjust their production, ordering and delivery plans accordingly.

The economic recovery that began during the second quarter of FY 2002 continued during the third quarter of FY 2002. Reflecting this improvement, the United States Mint’s shipments to the Federal Reserve for the third quarter of FY 2002 totaled approximately 4.5 billion coins; this figure represents a 67% increase over shipments for the second quarter of FY 2002, which totaled approximately 2.7 billion coins. This increase in shipments was associated with a revenue increase; circulating revenues for the third quarter of FY 2002 were approximately $376 million — up by 29% over revenues for the second quarter of FY 2002, which were approximately $291 million. 1 (See Table #1 and Table #2.)

Federal Reserve orders suggest that revenues from circulating coins for the fourth quarter of FY 2002 will match or exceed those for the third quarter of 2002.

Numismatic Items: During the third quarter of each fiscal year, the United States Mint usually releases numismatic products for the new calendar year. This third quarter release typically triggers increased sales of numismatic products that continues until about Christmas. Reflecting this expected upturn, numismatic revenues for the third quarter of FY 2002 were approximately $89 million — up by 170% from revenues for the second quarter of FY 2002, which were approximately $33 million (See Table #1.)

Numismatic revenues for the third quarter of FY 2002 were comparable to those for the third quarter of FY 2001, differing by only about 3%. (See Table #2.) This relative stability reflects a revenue increase of $9.8 million from recurring numismatic programs but a revenue decrease of $1.3 million dollars from commemorative coins and a revenue decrease of $11.8 million from American Eagle Proofs.

As it usually does, the third quarter spike of numismatic sales will likely level off during the fourth quarter of FY 2002. But, at the same time, numismatic sales will be encouraged by the availability of the United States Mint’s new print catalogue and the release of two popular products: the Silver Proof Set from San Francisco and the American Eagle Platinum Proof. As a result, numismatic revenues for the fourth quarter of FY 2002 are expected to range between $60 million and $65 million. This projected figure is comparable to numismatic revenues for the fourth quarter of FY 2001, which were $63.5 million.

Bullion Coins: The United States Mint usually releases American Eagle Bullion Coins for the new calendar year during the second quarter of each fiscal year. This release typically generates increased sales of American Eagle Bullion Coins during the second quarter of the fiscal year that are not sustained during the third quarter of the fiscal year. Reflecting this expected third quarter decrease, revenues from American Eagle Bullion Coins for the third quarter of FY 2002 were about $23 million — down by 55% from revenues for the second quarter of FY 2002, which were about $51 million. (See Table #1.)

Revenues from American Eagle Bullion Coins for the third quarter of 2002 matched those for the third quarter of FY 2001. (See Table #2.)

When stock values fall, investors transfer funds from stocks to precious metals, including American Eagle Bullion coins. Therefore, the current lack of investor confidence suggests that American Eagle Bullion Coin revenues for the fourth quarter of 2002 will likely increase to about $34 million.

1Although coin shipments increased by 67% from the second to the third quarter of FY 2002, circulating revenue increased by 21%. This disparity is due to the fact that much of the 67% increase in coin shipments was generated by shipments of relatively low value coins (particularly pennies), which earn less revenue for the United States Mint than coins of high value, such as dollars, quarters and half dollars. If higher value coins had accounted for more of the increased coin shipments, revenue increases would have more closely paralleled increases in coin shipments.

Update on Mint Activities

Safety

The United States Mint’s year-to-date Lost Time Accident (LTA) rate increased from 1.8 per 200,000 hours through the second quarter of 2002 to 2.1 through the third quarter of 2002. Nevertheless, this 2.1 rate remains significantly lower than the LTA rate of 3.4 through the third quarter of FY 2001. Moreover, if the United States Mint maintains its LTA rate of 2.1 through the fourth quarter of FY 2002, the decline of its yearly LTA will continue, as its has generally done since the mid-1990s. (See Chart #1.)

The United States Mint’s Lost Time Accident Rate

During this production suspension, Mint professionals and consulting experts in safety, job hazard analysis and various other disciplines conducted a top-to-bottom review of the Philadelphia Mint’s safety and housekeeping programs, and made numerous improvements to them. Most visibly, the walls and ceiling of the Philadelphia Mint were professionally cleaned and painted for the first time in the facility’s more than thirty years of operation, and the facility’s light fixtures, which bore bulbs of differing intensities and color, were overhauled. In addition, clutter and non-operational wiring were removed, employees were trained in preventing falls, procedures for storing all chemicals were verified, and emergency procedures were reviewed.

These activities improved safety by reducing tripping, electrical and fall hazards, enhancing emergency preparedness, improving visibility, improving employee concentration and increasing employees’ sense of responsibility for facility maintenance. These activities also boosted the building’s energy efficiency.

During the production suspension, the United States Mint also trained/retrained Philadelphia Mint employees in accident prevention and completely rewrote and implemented twenty-six safety-related programs. (These programs are currently being standardized throughout all Mint facilities.) The United States Mint has also been analyzing additional long-term safety improvements designed to prevent future safety shut-downs at all Mint facilities.

Through such efforts, the United States Mint has completely eliminated most safety and housekeeping deficiencies noted by OSHA in February 2002. It is also continuing to implement plans that have been approved by OSHA for addressing any remaining issues.

Golden Dollar Activities

The United States Mint regularly slows production of particular coin denominations on a temporary basis when supplies warrant. In May 2002, the United States Mint suspended production of circulating quality Golden Dollars because supplies of these coins were sufficient to meet demand for them. Contrary to some erroneous news reports, however, this suspension did not mark the end of the Golden Dollar Program. In July 2002, the United States Mint will resume limited production of circulating quality Golden Dollars for rolls and bags to meet the demands of coin collectors. Additional production of Golden Dollars will resume as warranted by future circulating and collecting demands.

On May 17, 2002, Director Fore testified before the Senate Appropriations Committee, Subcommittee on Treasury and General Government about the Golden Dollar Program. Her testimony reviewed the $953.5 million in revenues from seignorage generated by the Program during its first two years, and the status of the United States Mint’s outreach campaign encouraging the industrial, transit and consumer sectors to accept and use Golden Dollars. Director Fore also covered barriers limiting the circulation of Golden Dollars, including the difficulties of simultaneously accommodating the differing packaging needs of the banking, vending and retailing sectors, the failure of many cash ordering systems to allow banks to specifically order dollar coins when they order dollars from the Federal Reserve, and the commingling of Golden Dollars with the less popular Susan B. Anthony dollars, which discourages retailers from using Golden Dollars.

In addition, Director Fore explained that the United States Mint is also currently working to overcome barriers to Golden Dollar circulation by:

- Working with the Federal Reserve, financial institutions and business owners to address coin distribution problems.

- Jointly conducting a study with the Federal Reserve to determine the feasibility of reducing the number of Susan B. Anthony dollars in circulation or developing processes to automatically separate Susan B. Anthony dollars from Golden Dollars. The United States Mint will present recommendations generated by this study to Congress during the fourth quarter of 2002.

- Using the Mint’s product licensing program to move more Golden Dollars into circulation.

- Partnering with the U.S. Army Corps of Engineers in support of its bicentennial celebration of the Lewis & Clark Expedition.

- Working with Congress and the Bush Administration to increase the Golden Dollar’s use in daily cash transactions.

New Business Practices In Procurement

Since January 2001, analyses conducted by various organizations have produced recommendations for reforming the Office of Procurement’s policies and procedures. These analyses include an internal review of procurement activities conducted by the Mint’s Acquisitions Task Force, an Acquisition Management Assistance Review (AMAR) of the Mint’s procurement activities conducted by the Treasury Department in October 2001, and several audits and investigations conducted by the Office of the Inspector General. (Many of the recommendations produced by simultaneous internal and external analyses were similar and therefore overlap with one another.)

The Office of Procurement has completed a series of projects that have already put into effect many of the recommendations resulting from these recent analyses. For example, as recommended, the United States Mint has taken special measures to ensure that major procurement projects reflect the planning and coordination of an integrated team composed of representatives from all involved offices. To this end, the United States Mint has been stringently enforcing Mint-Wide Policy Memo Proc-25, which requires the purchase of all goods and services worth more than $100,000 to be managed by an Acquisition Management Team. Each Acquisition Management Team includes a representative from the office requesting the purchase, the Office of the Chief Counsel, the Procurement Office, the Office of Financial Planning and Research, and the Accounting Office, when appropriate.

In addition, to address recommendations that the United States Mint promote competition among its vendors, the Mint is currently creating a Standard Operating Procedure for expanding the vendor pool. This procedure involves using FedBizOpps, which is posted on the Internet at FedBizOpps.com. At this site, Federal buyers post business opportunities worth more than $25,000, and commercial venders seeking Federal clients, monitor and retrieve opportunities solicited by the entire Federal contracting community. The United States Mint is also encouraging compliance with its procurement regulations by, among other measures, posting and maintaining all relevant policy and guidance documents on its Intranet to ensure their easy accessibility. The United States Mint is committed to using procurement processes that reflect sound judgment.

Coin Redesign

The United States Mint is aware that members of the American public, the Congress, and the coin collecting community have expressed interest in redesigning all of the Nation’s circulating coinage. For instance, one proposal before Congress calls for a four-year Lewis & Clark Bicentennial Nickel Program commemorating the Louisiana Purchase, the Lewis & Clark Expedition, and one of the main forces behind westward expansion: President Thomas Jefferson.

The United States Mint is poised to facilitate circulating coin redesign, should Congress endorse such an initiative. To ensure that America’s coinage embodies the motto, E Pluribus Unum — “from many, one” — the United States Mint recognizes that our circulating coins must reflect our diversity as a people and our unity as a nation. Accordingly, any large-scale coin redesign endeavor will involve consulting and collaborating with appropriate Congressional offices; a broad cross-section of the American public; and individuals and experts who represent historical, artistic, numismatic, and other relevant communities. The United States Mint is prepared to orchestrate the many processes that would be needed to select new designs for our circulating coins.

50 State Quarters Program

In 2003, the United States Mint will release five new commemorative quarter-dollar coins in the 50 State Quarters Program: Illinois, Alabama, Maine, Missouri, and Arkansas. Designs for all five of these State Quarters are expected to be finalized by early August 2002.

Candidate designs for the Illinois, Alabama, Maine and Arkansas state quarters have been approved by the Secretary of Treasury. A final design for each of these state quarters will be selected by the Governor of the associated state by early August 2002. As requested by the Governor of Missouri, the United States Mint is currently creating an additional design for the Missouri State Quarter. Upon completion by the Mint, this additional state quarter design will be reviewed by the Commission of Fine Arts and the Citizens Commemorative Coin Advisory Committee.

On April 24th, the United States Mint submitted its marketing plan for the 50 State Quarters Program to the House and Senate Committees on Appropriations.

Inventory Management System

The United States Mint and the Federal Reserve are working together in the Coin Efficiencies Workgroup to streamline and reduce the costs of coin manufacturing and supply. The Workgroup’s current projects include developing an inventory management and forecasting tool that supports coin forecasting, ordering and production planning. After this tool is pilot-tested in the 12th Federal Reserve District, it will be adopted by the entire Federal Reserve system during the fourth quarter of FY 2002. The Workgroup is also pilot-testing a United States Mint/Federal Reserve coin shipping schedule extranet application in three Federal Reserve offices. This schedule is expected to be fully implemented during the fourth quarter of FY 2002.

American Eagle Silver Bullion Program

On June 28, 2002, Congress passed S. 2594, the “Support of American Eagle Silver Bullion Program Act.” The enrolled bill authorizes the Secretary of the Treasury to purchase silver on the open market when the silver stockpile is depleted. The Secretary is currently restricted to obtaining silver for bullion coins by purchase from silver stockpiles established under the Strategic and Critical Materials Stock Piling Act and administered by the Defense Logistics Agency. Enrolled bill S. 2594 removes that limitation and authorizes the Secretary to obtain silver mined from natural deposits in the United States. If it is not economically feasible to obtain such silver, the Secretary may obtain the silver from other available sources. This bill allows the United States Mint to continue its popular and revenue-generating American Eagle Silver Bullion Program. The United States Mint is the largest seller of silver coins in the world; it has generated $264 million in the last six years.

Each Silver Eagle contains one ounce of .999 pure silver, and is sold based on the current market price plus a premium to cover minting, marketing and distribution costs. The Silver Eagle, which first went on sale November 20, 1986, is the first and only silver bullion coin produced by the United States Mint. The American Eagle Silver Bullion Program provides investors with a U.S. government-produced product to add to their portfolio. The enrolled bill is now pending the President’s signature.

Other Highlights

Third Quarter Audits

During the third quarter of 2002, the Treasury Office of the Inspector General (OIG) issued three audit reports to the United States Mint:

- As requested by the United States Mint, the OIG audited the Mint’s proposal for termination for convenience with one of its contractors. The results of the OIG’s audit, which were presented in Audit Report on Evaluation of Termination Proposal Submitted Under Contract TM-K-196 [Audit Report OIG-02-080, will provide the basis for the Mint’s contract termination negotiations with the contractor.

- As requested by Senator Richard C. Shelby (R-AL), the OIG investigated four allegations leveled against the Mint by a supplier of precision grinding systems. As explained in the OIG’s report, Allegations Regarding the United States Mint’s Procurement of Die Shop Grinders Were Not Substantiated [Audit Report OIG-02-089], the OIG found no evidence substantiating three of the supplier’s allegations. Nevertheless, the OIG did determine that the Mint and the complainant shared some degree of responsibility for the premature wear of grinding machines, which was the focus of the supplier’s fourth allegation. However, the OIG did not issue any formal recommendations addressing this matter.

- As requested by Senator Charles E. Grassley (R-IA), the OIG audited Treasury-wide practices for inventorying sensitive property that — if lost or stolen — might compromise public safety and/or national security. In its report, “U.S. Mint’s Control Over Sensitive Property Needs To Be Improved [OIG-02-094], the OIG identified areas in which controls warrant strengthening. In response, the Mint has initiated corrective actions, as recommended.For example, the OIG recommended that all weapons and ammunition maintained by the United States Mint’s Protection Business Unit undergo an independent audit once per year. To accommodate this suggestion, the United States Mint’s Office of Management Services, which is independent of the Protection Business Unit, will conduct annual inventories of the Protection Business Unit’s weapons and ammunition based upon physical observations, and then reconcile results with the Protection Business Unit’s inventory records.Also as recommended by the OIG, the United States Mint migrated its property and computer information contained in its EasyVista software system to its PeopleSoft system, which is the Mint’s enterprise system. To comply with another OIG recommendation, the United States Mint’s Protection Business Unit will soon issue a policy ensuring that the United States Mint classifies badges and credentials as sensitive property, and accounts for them accordingly.

Also during the third quarter of 2002, Senator Grassley conducted a Congressional inquiry of charge card abuse in the Treasury Department for FY 1999 through FY 2001. As part of this inquiry, the OIG — in April 2002 — submitted to Senator Grassley statistical information from each Bureau, including the Mint, on the number of cards issued, total expenses incurred, reported instances of misuse or abuse and disciplinary actions taken.

Analyses of this information showed that United States Mint employees have higher rates of misuse and abuse of their government travel credit cards than employees of other Treasury bureaus. The United States Mint considers this a serious issue and is committed to resolving it. To this end, it has reminded Mint employees of the importance of adhering to regulations on the use of government travel credit cards and is reviewing statements from these cards to support rapid identification of misused or delinquent cards. The United States Mint is also developing a new policy that would clarify and educate supervisors on disciplinary actions that may be brought against employees who violate regulations on the use of government travel credit cards.

Medals

On May 16, 2002, President George W. Bush commemorated the distinguished public service records of former President Ronald Reagan and former First Lady Nancy Reagan by presenting Mrs. Reagan with a Congressional Gold Medal known as “The Ronald and Nancy Reagan Medal.”

General Henry H. Shelton, the former Chairman of the Joint Chiefs of Staff, will be presented with a Congressional Gold Medal in an award ceremony planned for September 2002. The United States Mint has already created preliminary medal designs and received approval for them from General Shelton.

Louisiana State Quarter Released

The United States Mint has co-hosted a launch ceremony to mark the release of each of the 17 new quarters in the 50 State Quarters. Maintaining this tradition, the United States Mint and Louisiana Governor M.J. “Mike” Foster jointly organized a launch ceremony commemorating the release of the Louisiana State Quarter, the 18th State Quarter. This ceremony was held at the Historic United States Mint in New Orleans on May 30, 2002.

At the ceremony, Director Fore, United States Treasurer Rosario Marin, Governor Foster and other distinguished guests spoke about the Louisiana Quarter, the 50 State Quarters Program and the United States Mint’s various education programs. The event was attended by over 2,000 members of the public and was covered by numerous print, radio and television media outlets.

The United States Mint is tentatively scheduled to participate in the launch of the Indiana State Quarter on August 8, 2002 at the International Motor Speedway near Indianapolis. This launch will be the last of FY 2002, but not the last of the calendar year. The launch of the Mississippi quarter will follow later in calendar year 2002.

Euro Coin Set Released

On June 12, 2002, the United States Mint released the 50 State Quarters & Euro Collection. Commemorating this important year in coin history, each set includes one 50 State Quarter from each of the five states releasing these coins in 2002: Tennessee, Ohio, Louisiana, Indiana and Mississippi.

Each set also includes one euro coin from each of the 12 European Union nations that replaced its currency with the euro in 2002: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal and Spain. Coins in the 50 State Quarters & Euro Collection are packaged in rotating capsules and are accompanied by text describing interesting historical information and design facts.

1999-2001 Proof Set Collection Discontinued

The United States Mint recently released for sale a 1999-2001 Proof Set Collection composed of products from previous years that were held back to allow new collectors to the 50 State Quarters Program to fill gaps in their collections.

Unfortunately, though, the United States Mint subsequently discovered tarnishing and discoloration on coins in a limited number of the 1999-2001 Proof Set Collections; this deterioration probably occurred during storage. As a result, the United States Mint discontinued sales of the Proof Sets Collections on June 12, 2002. Rather than risk selling additional inferior sets, the United States Mint will destroy all sets remaining in its inventory.

To date, the United States Mint has received about 15,700 orders and 150 returns (<1%) of the 1999-2001 Proof Set Collections. Orders for sets received before June 13, 2002 were processed, and all requests for exchanges have been honored.

Licensing Agreements

In February 2002, the United States Mint signed a licensing agreement with The Source International (TSI) that will assure high visibility for the Golden Dollar and 50 State Quarters Programs among the Nation’s more than 72 million NASCAR fans nationwide. (TSI is a motor sports marketing and licensing company and a corporate partner for the Cadillac Grand Prix.) Under this agreement, United States Mint products will be promoted by TSI’s development of marketing programs that feature Golden Dollar and 50 State Quarter designs on NASCAR cars, as well as by TSI’s sales and marketing of replicas of NASCAR cars bearing Golden Dollar and 50 State Quarter designs. Although this agreement involves no outlay of public funds by the United States Mint, the United States Mint will receive royalty payments from TSI for the sale of licensed merchandise.

The United States Mint continues to maintain active licensing agreements with Hallmark and — through an agreement with the Jim Henson Company — the H.E. Harris & Co. Products marketed under these agreements include storybooks, coin albums and folders, portfolios, handbooks, bookmarks, magnifiers, coin collecting kits, coin wrappers and tubes, among other products. These licensing agreements provide benefits by educating the public about historical events, stimulating interest in coin-collecting, giving the Mint entry into mass retail markets that would otherwise remain inaccessible, enhancing branding of the United States Mint and earning royalties that help reduce the national debt. To date, the Mint has earned over $2 million in royalties through licensing agreements.

Also during the third quarter of FY 2002, the Mint established a Licensing Office to consolidate all of its licensing efforts, as recommended by a United States Mint Task Force that reviewed the Mint’s licensing policy and procedures.

A Look Ahead

Customer Care Center Functions Consolidated

The United States Mint is reorganizing its customer care activities to improve customer care and reduce costs. As part of this reorganization, the United States Mint’s Customer Care Center (CCC) in Lanham, Maryland will close on August 5, 2002. At the same time, all order taking and processing of orders currently handled by CCC contractors in Lanham, Maryland will be transferred to a commercial call center in Plano, Texas, which already handles most of the United States Mint’s order-taking and processing.

The CCC’s 54 full-time employees will be reassigned to Headquarters in Washington D.C. Many of them will assume assignments at a new CCC at Headquarters that will involve resolving complex customer issues related to merchandizing and inventorying issues also managed at Headquarters. Because the United States Mint is working to seamlessly transfer all of the responsibilities currently handled by CCC’s contractors and full-time employees, the CCC reorganization will not disrupt customer service.

The reorganization of the United States Mint’s customer care functions will provide many benefits. First, resulting space efficiencies and the elimination of lost time and transportation expenses from shuttling employees between Headquarters iin Washington D.C. and the CCC in Lanham, Maryland will save more than $3,700,000 over the next five years. In addition, by increasing the geographical proximity between employees who work on customer care, merchandising and inventorying issues, the reorganization will improve communication and speed resolution of customer complaints. Similarly, the reorganization will foster better coordination between the United States Mint’s Customer Care and public information staffs, whose responsibilities often overlap. Finally, the consolidation of order taking and processing with a single contractor should improve customer service.

The reorganization of the CCC’s functions follows the March 2002 expiration of CCC’s lease on its Lanham, Maryland facility.

Tours

Denver: Since September 11, tours of the United States Mint in Denver have been suspended because of security concerns. In July 2002, tours of this facility will resume for organized school groups and for individual parties of up to six people that make arrangements through a Congressional office. These tours will run Monday through Friday, 8:00 A.M. to 2:00 P.M. (As always, tour schedules are subject to temporary changes needed to accommodate official events held at the Mint.)

Philadelphia: The United States Mint in Philadelphia is currently closed to tours because of ongoing construction. Tours of this facility are expected to resume in August 2002 on the same limited basis as that planned for the United States Mint in Denver.