In the conference report to Public Law 104-52, enacted November 19, 1995, which created the United States Mint Public Enterprise Fund (PEF), Congress directed the Mint to report quarterly on implementation of the PEF. Since that time the Mint has reported on implementation and how it is using PEF flexibilities. This is the twenty-eighth quarterly report and includes content that is prospective as well as retrospective.

Table of Contents

Summary

- First quarter FY 2003 revenues: Circulating Coins: $232 million, which is a 43 percent decrease from the previous quarter. Numismatic Products: $46 million, which is a 46 percent decrease from the previous quarter. Bullion Coins: $32 million, which is a 48 percent decrease from the previous quarter.

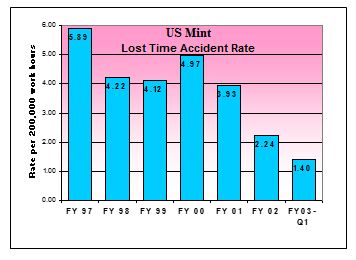

- The United States Mint’s safety record continues to improve.

- The Mississippi State Quarter was released.

- The Golden Dollar Research Program was completed.

- The United States Mint is developing partnerships with the Bureau of Engraving and Printing and the United States Postal Service.

- The United States Mint ran a special holiday advertising campaign.

- The United States Mint won a 2002 Federal Energy and Water Management Award from the United States Department of Energy.

- The United States Mint was the top rated Federal Government agency in the American Customer Satisfaction Index and ranked in the top 10 among private businesses.

- United States Mint employees were rewarded for efficiency improvements through gainsharing payouts.

- The United States Mint’s new Deputy Director is David Lebryk.

- The United States Mint and the Federal Reserve are improving coin production planning and inventory management.

- The United States Mint developed an Extranet application that will help improve the Mint’s supply chain management.

OTHER HIGHLIGHTS: Sales of the Kennedy Half-Dollar are exceeding expectations./ Planning is underway for the Mint Directors Conference meeting from March 18-23, 2004./ The Citizens Commemorative Coin Advisory Committee has three openings./ Preparations are progressing for production of the 2003 First Flight Centennial Commemorative Coin, the 2004 Lewis and Clark Commemorative Coin, and the 2004 Thomas A. Edison Silver Coin./ The popularity of the United States Mint’s educational resources is steadily growing./ 337 first-line and second-line supervisors and union stewards participated in an “Achieving New Era Values Through Leadership” workshop that emphasized accountability, leadership, trust/respect/integrity, teamwork and communication./ The United States Mint looks forward to facilitating coin redesign, should Congress endorse such an initiative./ The United States Mint received an unqualified audit opinion for 2002.

A LOOK AHEAD: The Annual Report for FY 2002 will be published in February 2003.

State of the Mint

The United States Mint’s main responsibilities are:

- Producing an adequate volume of circulating coins for the Nation to conduct its trade and commerce, and distributing these coins to the Federal Reserve. Manufacturing, marketing and selling proof and uncirculated coins, commemorative coins and medals to the general public. These products are known as numismatic products.

- Manufacturing, marketing and selling gold, silver and platinum bullion coins through the American Eagle Bullion Program. The value of American Eagle Bullion Coins generally depends upon their weight in specific precious metals. (By contrast, the numismatic value of other types of coins generally depends upon factors such as mintage, rarity, condition and age.) American Eagle Bullion Coins provide investors with a simple and tangible means to own precious metals. Not sold directly to the general public by the United States Mint, these products are available through precious metal dealers, coin dealers, brokerage companies and participating banks.

- Safeguarding United States Mint assets and non-Mint assets that are in the Mint’s custody, including bullion reserves at the Fort Knox Bullion Depository and elsewhere.

Status Of The Public Enterprise Fund

The United States Mint’s Public Enterprise Fund is financed by the sale of circulating coins to the Federal Reserve and the sale of numismatic and bullion coins and other products to customers world-wide.

Table #1

QUARTERLY COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2003 1st Qtr |

FY 2002 4th Qtr |

Change |

|---|---|---|---|

| Circulating | $232 | $408 | -43% |

| Numismatics | $46 | $85 | -46% |

| Bullion* | $32 | $62 | -48% |

| TOTAL | $310 | $555 | -44% |

Table #2

FISCAL YEAR COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2003 1st Qtr |

FY 2002 1st Qtr |

Change |

|---|---|---|---|

| Circulating | $232 | $289 | -20% |

| Numismatics | $46 | $52 | -11% |

| Bullion* | $32 | $49 | -35% |

| TOTAL | $310 | $390 | -21% |

* These are investment versions. Proof versions of American Eagles will be included in numismatic sales when offered.

Circulating Coins: The demand for circulating coins by commercial establishments and the general public fluctuates with the United States’ ever-changing economy. To accommodate this variability, the United States Mint and Federal Reserve continually assess their inventories and the demand for circulating coins, and adjust their production, ordering and delivery plans accordingly.

As discussed in this report’s “Coin Inventory Management section,” the Federal Reserve implemented a new system for managing coin inventories and for ordering coins. This development compelled the Federal Reserve to reduce its coin orders. As a result, during the first quarter of FY 2003, the United States Mint shipped about 2.5 billion coins to the Federal Reserve. This figure represents about a 49% decline from the 4.9 billion coins that were shipped during the fourth quarter of FY 2002.

This decrease in shipments was accompanied by a decrease in circulating revenues. The United States Mint’s circulating revenues for the fourth quarter of FY 2002 totaled only $232 million. This figure represents about a 43% decline from the $408 million earned during the fourth quarter of FY 2002. (See Table #1.) In addition, circulating revenues for the first quarter of FY 2003 were about 20 percent lower than those for the first quarter of FY 2002, which totaled about $289. (See Table #2.)

The Federal Reserve’s coin order for January 2003, as well as its projected orders for February and March 2003, suggests that circulating revenues during the second quarter of FY 2003 will be higher than those during the first quarter of FY 2003.

Numismatic Products: Numismatic revenues totaled $46 million during the first quarter of FY 2003, when no new major products were introduced. This figure represents a 46 percent decline from the $85 million in numismatic revenues earned during the previous quarter, when a variety of new numismatic products were introduced. (See Table #1.)

In addition, numismatic revenues for the first quarter of FY 2003 were about 11 percent lower than those from the first quarter of FY 2002, which totaled about $52 million. (See Table #2.) It should be noted, however, that numismatic revenues for the first quarter of FY 2003 were low only by comparison to the unusually high revenues of the first quarter FY 2002.

The United States Mint will not release any recurring products during the second quarter of FY 2003. Therefore, during this period, numismatic revenues will probably range form about $20 million to $25 million. However, numismatic revenues will likely increase during the third and fourth quarters of FY 2003, when the recurring products will be launched.

Bullion Coins: Bullion revenues for the first quarter of FY 2003 totaled about $32 million. This figure represents a 48 percent decline from bullion revenues for the previous quarter. (See Table #1.) In addition, bullion revenues for the first quarter of FY 2003 were about 35 percent lower than those for the first quarter of FY 2002, which totaled about $49 million. (See Table #2.) Bullion revenues will probably increase next quarter, and range from about $90 million to about $100 million. This projection is based upon precious metals prices, which are currently at a six-year high.

Update on Mint Activities

Safety

Since the mid-1990s, the United States Mint’s Lost Time Accident (LTA) rate1 has generally trended downwards. (See chart on page #1.) During the first quarter of 2003, the United States Mint’s LTA rate was 1.40; if the United States Mint maintains this rate throughout the rest of the fiscal year, it will significantly improve on its FY 2002 LTA rate, which was 2.24.

During November 2002, the United States Mint achieved an important safety milestone: its first month without an LTA in any of its six facilities. This was the first month that the United States Mint remained entirely LTA-free during the six years for which detailed monthly records are available. (As reported in the United States Mint’s previous PEF report, none of the United States Mint’s five field facilities experienced a single LTA during the entire month of July 2002.)

To further improve its safety record, the United States Mint retained the services of DuPont Safety Resources, a consulting firm that specializes in helping public and private organizations improve their workplace safety and health records while improving their business performance.

During the first quarter of FY 2003, DuPont assessed and benchmarked safety and health practices at the United States Mint’s five field facilities and identified opportunities for improving safety at these facilities. Dupont is currently helping United States Mint managers develop action plans to address these opportunities, which will be implemented during FY 2003.

1 LTA rates are based upon the number of lost time accidents occurring per 200,000 work hours. All LTA rates cited in this report were based upon the actual number of hours worked by employees. (This method for calculating LTA rates is consistent with that used by all other Treasury bureaus.) By contrast, LTA rates cited in the United States Mint’s PEF reports covering time periods before the fourth quarter of FY 2002 were based upon the number of accidents that occurred per 200,000 hours of employment payment. Any discrepancy between LTA rates cited in this report and LTA rates cited in previous PEF reports is due to differing methods used for calculating work hours.

50 State Quarters Program

Quarter Launch: On October 22, 2002, Director Fore joined Governor Ronnie Musgrove to unveil the Mississippi State Quarter at the Mississippi Museum of Natural History in Jackson, Mississippi. About 1,200 school children attended the launch ceremony. The Mississippi Quarter showcases the blossoms and leaves of two magnolias with the inscription “The Magnolia State.” It was the fifth and the last State Quarter released in 2002, and the 20th State Quarter released in the 50 State Quarters Program. The Mississippi Quarter is now available in 100-coin and 1,000-coin bags and two-roll sets.

Quarter Designs: The Secretary of the Treasury approved final designs for all five State Quarters (Illinois, Alabama, Maine, Missouri and Arkansas) that will be released in 2003. Each of the five states that will be honored by the release of State Quarters in 2004 (Michigan, Florida, Texas, Iowa and Wisconsin) submitted its candidate designs to the United States Mint. The United States Mint’s engravers are currently rendering versions of these candidate designs, which — when completed — will be returned to the states for review. Designs for these 50 State Quarters coins will be finalized by June 2003.

Outreach: During the first quarter of FY 2003, the United States Mint solicited feedback from the numismatic and artistic communities, state officials, historians, educators and the general public on the 50 State Quarters Design Evaluation Process. This process was designed to help the United States Mint ensure that the Evaluation Process satisfies the 50 State Quarters Program’s enabling legislation, and is fair and equitable, easily understood and widely accepted. The feedback provided to the United States Mint indicates that its stakeholders widely accept the Evaluation Process. Nevertheless, they would like increased communication between the United States Mint and the states, increased communication between the states and the general public, and more educational content from the 50 State Quarters Program. Stakeholders would also like the Evaluation Process to show greater emphasis on historical accuracy and artistic beauty. The United States Mint is currently working to incorporate this feedback into its external and internal processes.

Golden Dollar Research Program

During the first quarter of FY 2003, the United States Mint completed the Golden Dollar Research Program, which had been initiated during the previous quarter. The United States Mint is currently drafting a summary of the Research Program’s findings that will describe barriers identified and the potential impacts of removing these barriers on net profit and circulation of Golden Dollars. This summary will be reviewed with the Congressional oversight committees.

Partnerships

United States Mint/United States Postal Service Partnership: During the first quarter of 2003, the United States Mint and the United States Postal Service (USPS) finalized an agreement to jointly launch two State Quarters/Greetings From America products:

- 50 State Quarters/Greetings From America Card Sets. Each Card Set will feature the following items for each of the five states honored with the release of a State Quarter during a particular year: a baseball card-sized state card and a State Quarter and a Greetings from America stamp. Each Card Set will retail for $27.99.

- 50 State Quarters/Greetings From America Portfolios. Each Portfolio with feature the following items for each of the five states honored with the release of a State Quarter during a particular year: scenic photographs from the state and a State Quarter and a Greetings from America stamp. Each Portfolio will retail for $29.99.

Card Sets and Portfolios will be launched by Director Fore and senior USPS officials at a ceremony scheduled for January 10, 2003 at the Mall of America in Minneapolis. Starting on January 13, 2002, Card Sets and Portfolios for 2002 will be sold on the United States Mint’s website, the USPS website, and at large postal retail locations throughout the nation. Card Sets and Portfolios representing future years will be released at the end of each year for the remaining duration of the program.

United States Mint/Bureau of Engraving and Printing Partnership: On September 25, 2002, the United States Mint initiated a partnership with its sister agency, the Bureau of Engraving and Printing (BEP), by selling new uncut sheets of $1.00, $2.00 and $5.00 bills. These products, which were included in the United States Mint’s 2002 catalog, have been extremely popular with the public.

The United States Mint and BEP are currently discussing expanding their successful partnership by jointly launching several new products that would package coins together with intaglio engravings in the spring or summer of 2003. (Intaglio engravings are a type of detailed, decorative engraving.)

The “Genuine United States Mint” Ad Campaign

From November 29, 2002 to December 30, 2002, the United States Mint ran a holiday television and print advertising campaign that was designed to promote sales of the full line of United States Mint products and enhances brand and name recognition. As part of this campaign, the United States Mint ran print advertisements in USA Today, Newsweek, People and TV Guide, and aired television commercials on major cable and network channels, such as NBC, the History Channel, CNN, Lifetime, Discovery, and A&E. Approximately $2.5 million was budgeted for this campaign. Three of the United States Mint television spots won First Place Aegis Awards. The spots are “Memories,” “American History” and “Corinth.” The Aegis Awards were started ten years ago by a group of independent directors and producers. The national competition features peer judging by industry professionals, including directors, producers, writers, editors and cameramen.

The United States Mint Wins Federal Energy Management Award

In December 2002, the United States Mint won a 2002 Federal Energy and Water Management Award from the United States Department of Energy. This is the third time that the United States Mint has won this award during the last ten years.

This latest award recognizes an aggressive energy savings program implemented at the United States Mint’s San Francisco facility. Through this program, the United States Mint eliminated 4.6 billion BTUs of energy consumption, reduced water consumption by nearly 1.7 million gallons, reduced carbon emissions by 116 metric tons and saved the facility more than $100,000 in avoided costs during FY 2001, which is comparable to an 11 percent energy savings. These savings advance the goal set forth in Executive Order 13123 of reducing energy consumption by 20 percent by 2005.

The United States Mint’s energy savings program is based upon improved employee awareness, innovative personnel scheduling, numerous equipment modifications, and the replacement of old, single-paned windows with more energy-efficient double-paned windows — an achievement that was particularly challenging because the United States Mint’s San Francisco facility is listed on the National Register of Historic Places.

United States Mint Ranks High on American Customer Satisfaction Index

2002 marks the seventh straight year that the United States Mint ranked among the leaders in the public and private sectors on the American Customer Satisfaction Index (ACSI), an annual survey conducted by the University of Michigan Business School. With a score for FY 2002 of 84 on a 1-to-100 scale, the United States Mint outscored all other Federal agencies — including all of the other 23 high-impact Federal agencies.

The United States Mint’s performance in the ACSI showed that it is on par with the very best companies in the private sector. If the United States Mint were a private company, it would have scored among the top ten performers in the private sector; it would have been outscored only by companies such as H.J. Heinz, Hershey Foods, Quaker Oats, Cadbury Schweppes, Pepsico and Coca Cola.

Gainsharing

From FY 2001 to FY 2002, the United States Mint’s Lost Time Accident (LTA) rate dropped by 42% from 3.91 to 2.2, and its operating costs (General and Administrative Expenses and Conversion Costs) declined by six percent or $25 million. The United States Mint rewarded its employees for their collective contributions to these improvements through its gainsharing program.

The United States Mint’s gainshairing pool is computed according to a formula that incorporates performance measures that align with the Mint’s Strategic Plan. These performance measures also reflect factors that can be influenced by employees, rather than variables that are insulated from employee influence, such as coin demand, production targets or budgets. All inputs into the gainsharing formula are validated and audited.

Under the United States Mint’s gainsharing formula, each eligible employee who amassed 1,800 service hours during FY 2002 received a full-share gainshairing payout of $1,866. Those who accumulated fewer hours received prorated shares.

New Deputy Director

On September 30, 2002, David A. Lebryk became Deputy Director of the United States Mint. Before joining the United States Mint, Mr. Lebyrk served as the Treasury Department’s Deputy Assistant Secretary for Fiscal Operations and Policy, where he managed programs involving cash management, investment and administration of trusts, payments and collections. He also previously served as Acting Deputy Assistant Secretary for Human Resources.

Mr. Lebryk joined the Treasury Department in 1989 as a Presidential Management Intern. He holds a Masters of Public Administration from the John F. Kennedy School of Government, and a B.A. in Economics from Harvard College.

Coin Inventory Management

The United States Mint and Federal Reserve are currently working together on several projects to improve coin production planning and inventory management. For example, the United States Mint is supporting the Federal Reserve’s use and refinement of a new, jointly developed coin inventory and forecasting tool that improves the accuracy of the Federal Reserve’s coin orders. The United States Mint is also continuing to support efforts to reduce and balance Federal Reserve coin inventories by transferring previously circulated coins from Reserve Banks that have excess supplies to nearby Reserve Banks that need additional coins. This method of redistributing coins has helped lower Federal Reserve orders for shipments of new coins from the United States Mint. In addition, the United States Mint and Federal Reserve are better integrating their planning, thereby enabling the Federal Reserve to reduce its unwanted inventories of older State Quarters that are in less demand than newer State Quarters.

During the first quarter of FY 2003, the Coin Efficiencies Workgroup finished testing a new Extranet application that will save the United States Mint and Federal Reserve time and money by automating many laborious tasks involved in maintaining and updating the Mint’s schedules for coin shipments to the Federal Reserve. It will also improve communication by providing the Federal Reserve with secure, 24/7 access to coin shipping information, such as the departure dates, origins, destinations and denominations of coin shipments and information about coin transfers between Federal Reserve locations that are arranged by the United States Mint to help the Federal Reserve balance its coin inventories. The United States Mint expects to release this Extranet application to the Federal Reserve during the second quarter of FY 2003.

Supply Chain Management

The United States Mint is currently pursuing several initiatives that will contribute to the development of a fully integrated supply chain that incorporates best in business practices, and addresses all segments of its supply chain — from raw material supplies to coin distribution. As part of this effort, the Supply Chain Management Workgroup, which includes representatives of the United States Mint, the Federal Reserve and suppliers of raw materials, is developing an Extranet application that will support information exchange between the United States Mint and its key suppliers. Progress made on this project during the first quarter of FY 2003 includes the development of an agreement with suppliers on the information to be shared and the design of appropriate screen formats for displaying this information. Once methods for ensuring the security of data are finalized, this Extranet application will be used to exchange information on production plans and forecasts. Future plans call for also using it to share information about material shipping schedules and supplier inventories.

The Supply Chain Management Workgroup is also working to improve forecasting and order management techniques by benchmarking against those used by industry leaders. In addition, the group is collaborating with the Federal Reserve Cash Product Office to ensure that coin ordering, inventory management and production better anticipate seasonal fluctuations in coin demand and help smooth United States Mint coin production.

Other Highlights

Kennedy Half Dollar Program

Sales of Kennedy Half Dollars, which were released on November 25, 2003, are currently exceeding expectations. The 2002-dated Kennedy Half Dollars are available in two-roll sets and bags of 200. They are sold via the United States Mint’s website and at the United States Mint’s sales kiosk at Union Station in Washington, DC.

Biennial Meeting of the International Mint Directors’ Conference

The United States Mint will host the XXIII biennial meeting of the International Mint Directors Conference (MDC) from March 18 to 23, 2004, in San Francisco, California. This meeting is expected to draw 500 to 600 representatives of national mints, dealers, industrial observers and marketing observers. The United States Mint is working to organize an informative, inclusive, business-oriented conference that will set the standard for future conferences. The United States Mint’s MDC meeting planning team has already drawn up the meeting’s invitation list, organized meeting sessions, enlisted champions for these sessions, and formed a marketing sub-committee.

According to MDC rules, the director of the mint hosting the MDC’s biennial meeting assumes the position of Vice President of the MDC. As the current Vice President of the MDC, Director Fore’s responsibilities include helping the MDC President direct the MDC, and reviewing and approving all correspondence between the MDC council and MDC members. In addition, Director Fore is committed to modernizing the MDC council by addressing a range of issues including the MDC’S membership criteria and the MDC’s objectives and practices. She is also helping to develop streamlined, action-oriented measures, and working to eliminate unnecessary bureaucracy that hampers leadership.

Citizens Commemorative Coin Advisory Committee

The Citizens Commemorative Coin Advisory Committee (CCCAC) is an organization that reviews proposed coin designs on behalf of the Secretary of the Treasury. The CCCAC identifies people, places or events for Congress to honor with commemorative coins. Vacancies on the CCCAC for a representative of the general public and for a representative of the special interest category are currently being reviewed. The public announcement to recruit for these two vacancies was released on November 7, 2002. After a panel review of the applications has been completed, the United States Mint will submit recommendations to the Secretary of Treasury. In addition to these two current vacancies, a United States Mint representative will be appointed to serve on the CCCAC to represent the interests of the United States Mint.

Commemorative Coins

2003 First Flight Centennial Commemorative Coins: The August 1, 2003 release of the series of gold, silver and clad coins will mark the 100th anniversary of the Wright Brothers’ historic flight at Kitty Hawk, North Carolina. A portion of the proceeds from sales of these coins will help pay for the upkeep of the Wright Brothers Monument in North Carolina.

During the first quarter of 2003, candidate designs for First Flight Commemorative Coins were reviewed by the CCCAC, the Commission of Fine Arts, and the First Flight Centennial Foundation. They are currently with the Secretary of the Treasury for his approval.

On December 17, 2002, the United States Mint participated in the First Flight Centennial kick-off event at Kill Devil Hills, North Carolina, by attending the event, distributing to attendees a four-color program produced by the Mint, and collecting the names of attendees who wish to receive the First Flight Centennial Commemorative Coin offering.

2004 Lewis and Clark Commemorative Coin: Release of this coin will mark the 200th anniversary of the Lewis and Clark expedition. During the first quarter of 2003, candidate designs for the 2004 Lewis and Clark Commemorative Coin were reviewed by the CCCAC and then by the Secretary of the Treasury.

2004 Thomas A. Edison Silver Dollar: Release of this coin will mark the 125th anniversary of Thomas Edison’s invention of the practical light bulb. During the first quarter of 2003, United States Mint engravers rendered candidate designs, which will next be reviewed by the CCCAC and the Commission of Fine Arts.

Education Initiatives

The United States Mint continues to receive positive feedback on the educational resources that it provides to the public. For example, a recent article in The Napa Valley Register noted that the quality of the United States Mint’s educational web site — which is called History In Your Pocket (H.I.P.) Pocket Change — demonstrates that “someone’s been very busy making learning a great feature at the U.S. Mint.” In addition, since H.I.P. Pocket Change was launched in 1999, it has drawn increasingly heavy traffic. The number of visits to H.I.P. pocket change jumped by 68 percent from the first quarter of FY 2003 to the first quarter of FY 2002.

Also, the release by the United States Mint of lesson plans for new 50 State Quarters coins is now an integral part of State Quarter launches. Evidence of this resource’s importance includes the 230,000 downloads of 50 State Quarters Lesson Plans made by the public during the first quarter of 2003.

Achieving New Era Values Through Leadership

As recommended by the United States Mint’s senior leadership team, 337 first and second level supervisors and union stewards participated in a new, one-day development workshop called “Achieving New Era Values Through Leadership” that was held during the first quarter of FY 2003. (The United States Mint’s New Era Values emphasize the importance of providing value to the American people, ensuring integrity in our commitments and communication, and achieving world-class performance). The United States Mint’s New Era Values are accountability, leadership, trust/respect/integrity, teamwork and communication.

The “Achieving New Era Values” workshop was designed to teach participants how and why they should promote the United States Mint’s New Era Values and the Mint’s ongoing Leadership for Results (LFR) initiative, which consists of training modules on communication and interpersonal skills that are provided to all United States Mint employees.

Coin Redesign

Members of the American public, Congress and the coin collecting community have expressed interest in redesigning all of the Nation’s circulating coinage. Changing the designs of our coins would generate substantial educational benefits, as well as inspire a renewed emphasis on our national character, pride, history and heritage.

The United States Mint recognizes that our circulating coinage must reflect our diversity as a people, our values and unity as a nation. The United States Mint also recognizes that any large-scale coin redesign effort would involve intensive collaboration with Congress, a broad cross-section of the American public and various individuals and experts who represent historic, numismatic, artistic and other communities. The United States Mint looks forward to continuing the dialogue with Congress and facilitating coin redesign, should Congress endorse such an initiative.

Audits of Financial Systems

The United States Mint received an unqualified audit opinion from an independent public accountant for its FY 2002 financial statements. This is the ninth year in a row that the United States Mint has done so.

In its Annual Assurance Statement for 2001 under the Federal Financial Management Integrity Act (FMFIA), the United States Mint reported two material weaknesses involving its IT general-level controls and application-level controls. During Fiscal Year 2002, the United States Mint improved its financial systems by issuing Mint-wide information security policies, defining and enforcing stringent system access roles, strengthening security access controls and conducting enhanced reviews of system vulnerabilities. These actions corrected significant aspects of the United States Mint’s two material weaknesses by September 30, 2002. Nevertheless, these material weaknesses did exist throughout much of the fiscal year.

Residual issues related to these two material weaknesses were consolidated into a single material weakness that was reported in the United States Mint’s Annual Assurance Statement for 2002. The United States Mint is aggressively working to eliminate this weakness by improving management controls, systems software and change management, increasing system access controls and conducting comprehensive reviews of business processes and internal controls.

A Look Ahead

Annual Report

The United States Mint will publish its 2002 Annual Report in February 2003. Copies will be provided to the public, Congress, other federal agencies, the numismatic press and other interested parties.