In the conference report to Public Law 104-52, enacted November 19, 1995, which created the United States Mint Public Enterprise Fund (PEF), Congress directed the Mint to report quarterly on implementation of the PEF. Since that time the Mint has reported on implementation and how it is using PEF flexibilities. This is the twenty-seventh quarterly report and includes content that is prospective as well as retrospective.

Contents

Summary

- Fourth quarter FY 2002 revenues: Circulating Coins: $408 million, up by 9% from third quarter. Numismatic Products: $85 million, down by 5% from third quarter. Bullion Coins: $63 million, up by 174% from third quarter.

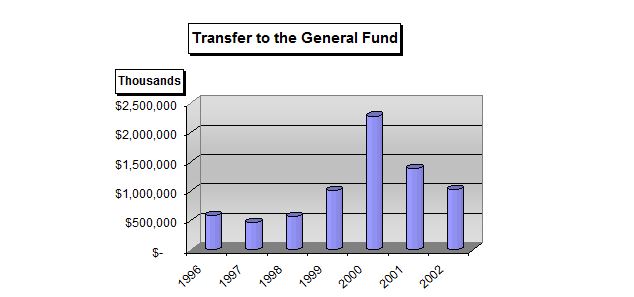

- The United States Mint transferred $1.03 billion to the General Fund.

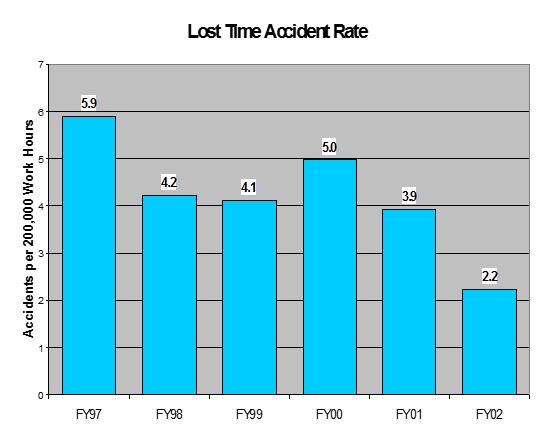

- The Lost Time Accident rate dropped from 3.9 in FY 2001 to 2.2 in FY 2002.

- The Indiana State Quarter was launched.

- A $2.1 million settlement was reached with Washington Mint, LLC.

- New partnerships were developed with the Bureau of Engraving and Printing and the United States Postal Service.

- Coin redesign activities are currently limited to studying the issue and contributing to nickel redesign legislation.

- The Federal Reserve used a new coin inventory management and forecasting tool to generate its monthly coin order and began testing a new Extranet application.

- The Supply Chain Management Workgroup will help develop a fully integrated supply chain for the United States Mint.

- The United States Mint has new software capabilities that have significantly improved customer service.

- A 1933 Double Eagle gold coin sold for a record $7,590,020.

- GAO issued one report and one draft report and initiated four studies, and OIG will initiate one study addressing Mint programs.

- The Golden Dollar Research Program was launched.

- OTHER HIGHLIGHTS: Three new commemorative coins are being prepared. The Customer Care Center moved to Headquarters. The United States Mint will host the XXIII Mint Directors Conference in 2004. The Citizens Commemorative Coin Advisory Committee has two new members. The 50 State Quarters & Euro Coin Collection was released. Controls on government credit cards for travel have been strengthened. General Henry H. Shelton received the Congressional Gold Medal. Mr. Jerry Horton became Chief Information Officer. The United States Mint in Philadelphia resumed tours. Two competitive sourcing studies are underway.

- A LOOK AHEAD: David A. Lebryk joined the United States Mint as Deputy Director.

State of the Mint

The United States Mint’s main responsibilities are:

- Producing an adequate volume of circulating coins for the Nation to conduct its trade and commerce, and distributing these coins to the Federal Reserve.

- Manufacturing, marketing and selling proof and uncirculated coins, commemorative coins and medals to the general public. These products are known as numismatic products.

- Manufacturing, marketing and selling gold, silver and platinum bullion coins through the American Eagle Bullion Program. The value of American Eagle Bullion Coins generally depends upon their weight in specific precious metals. (By contrast, the numismatic value of other types of coins generally depends upon factors such as mintage, rarity, condition and age.) American Eagle Bullion Coins provide investors with a simple and tangible means to own precious metals. Not sold directly to the general public by the United States Mint, these products are available through precious metal dealers, coin dealers, brokerage companies and participating banks.

- Safeguarding United States Mint assets and non-Mint assets that are in the Mint’s custody, including bullion reserves at the Fort Knox Bullion Depository and elsewhere.

Status Of The Public Enterprise Fund

The United States Mint’s Public Enterprise Fund is financed by the sale of circulating coins to the Federal Reserve and the sale of numismatic and bullion coins and other products to customers worldwide.

Table #1

QUARTERLY COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2002 4th Qtr | FY 2002 3rd Qtr | Change |

|---|---|---|---|

| Circulating | $408 | $376 | +9% |

| Numismatics | $85 | $89 | -5% |

| Bullion* | $63 | $23 | +174% |

| TOTAL | $556 | $488 | +14% |

Table #2

FISCAL YEAR COMPARISON OF REVOLVING FUND REVENUE

(Millions of Dollars)

| Product Category | FY 2002 4th Qtr | FY 2001 4th Qtr | Change |

|---|---|---|---|

| Circulating | $408 | $395 | +3% |

| Numismatics | $85 | $85 | +34% |

| Bullion* | $63 | $37 | +70% |

| TOTAL | $556 | $496 | +12% |

* Investment versions, proof versions will be included in numismatic sales when offered.

Circulating Coins: The demand for circulating coins by commercial establishments and the general public fluctuates with the United States’ ever-changing economy. To accommodate this variability, the United States Mint and Federal Reserve continually assess their inventories and the demand for circulating coins, and adjust their production, ordering and delivery plans accordingly.

During the fourth quarter of FY 2002, the United States Mint shipped about 4.9 billion circulating coins to the Federal Reserve — up by about 9% from the Mint’s shipment of about 4.5 billion circulating coins during the previous quarter. This increase in shipments was associated with a comparable increase in circulating revenues; during the fourth quarter of FY 2002, the United States Mint’s circulating revenues totaled about $408 million — up by about 9% from circulating revenues of $376 million during the previous quarter. (See Table #1.) Circulating revenues for the fourth quarter of FY 2002 were about 3% higher than those for the same quarter of the previous fiscal year, which totaled about $395 million. (See Table #2.)

Because the Federal Reserve is receiving a higher than usual flowback of circulating coins from its customers, the United States Mint does not expect shipments of circulating coins and associated revenues to continue increasing during the first quarter of FY 2003. This flowback is boosting inventories throughout the Federal Reserve system. As a result, the Federal Reserve has reduced its orders for circulating coins from the United States Mint, which will result in decreased shipments and revenues from circulating coins during the first quarter of FY 2003.

Numismatic Products: During the fourth quarter of FY 2002, numismatic revenues totaled about $85 million — down by about 5% from numismatic revenues during the previous quarter, which totaled about $89 million. (See Table #1.) This decrease is the net result of a $13 million decrease in revenues from Recurring Programs and a $9 million increase in revenues from the Proof Program.

Numismatic revenues from the fourth quarter of FY 2002 were about 34% higher than numismatic revenues from the fourth quarter of FY 2001, which totaled about $63 million. (See Table #2.) This increase is the net result of a $12.3 million increase in revenues from the Proof Program, a $14.6 million increase in revenues from Recurring Programs, the sale for almost $7.6 million of a one-of-a-kind 1933 Double Eagle, and a $12.7 million decrease in revenues from Commemorative Programs.

During the first quarter of FY 2003, numismatic revenues will probably range between $30 million and $40 million. This projection is based upon the likelihood that sales will remain strong through December 2002 but will not be augmented by any launches of major products.

Bullion Coins: During the fourth quarter of FY 2002, bullion revenues totaled about $63 million — up by about 174% from bullion revenues from the previous quarter, which totaled about $23 million. (See Table #1.) This increase may be attributable to various factors, including reduced investor confidence in the stock market, increased concerns over tensions between Iraq and the United States and the entry of a new silver bullion distributor into the market. In addition, the third quarter of the fiscal year typically yields the lowest bullion revenues for the entire fiscal year, and so fourth quarter revenues are usually higher by comparison.

Bullion revenues for the fourth quarter of FY 2002 were about 70% higher than bullion revenues from the same quarter last year, which totaled about $37 million. (See Table #2.) This revenue increase reflects recent increases in gold and platinum prices as well as the various factors mentioned above.

During the first quarter of FY 2003, bullion revenues are estimated to increase to between $65 million and $85 million. This projection is based upon our expectation that the December 2002 release of coins dated for 2003 will boost sales and the likelihood that current market conditions will continue into next quarter.

Transfer To The General Fund

During FY 2002, the United States Mint transferred $1.03 billion in profits excess to operating requirements to the Treasury General Fund. $990 million of the $1.03 billion was attributable to circulating coins, which enabled the Government to reduce the debt it issued, and $40 million of the $1.03 billion was attributable to numismatic and bullion operations, which was available to fund other Government operations.

Update on Mint Activities

Safety

The United States Mint’s Lost Time Accident (LTA) rate1has generally trended downwards since the mid-1990s. Through increased focus on safety in FY 2002, the United States Mint’s LTA rate declined by 43 percent from 3.9 in FY 2001 to 2.2 in FY 2002. (See chart on front page.)

The United States Mint’s reduced LTA rate reflects a reduction in the LTA rates for all but one of the United States Mint’s facilities, and a 73 percent reduction in the LTA rate of the United States Mint’s Protection Strategic Business Unit (the Mint Police) from 4.5 in 2001 to 1.2 in 2002. It should be noted that the Mint Police improved its safety record despite the special safety challenges posed during the post-September 11th period.

Furthermore, none of the United States Mint’s five field facilities experienced a single LTA during the entire month of July 2002. This was the first month that these field facilities remained LTA-free during the five years for which detailed monthly records are available.

Also noteworthy is improved safety at the United States Mint’s Philadelphia facility — as reflected by a 63 percent decline in its LTA rate from 5.2 in FY 2001 to 1.9 in FY 2002. This trend has resulted from an aggressive safety overhaul that included extensive equipment repairs, improved health and safety training and upgraded housekeeping following this facility’s suspension of minting operations. (As discussed in previous PEF reports, the suspension of minting operations at the United States Mint’s Philadelphia facility was from March 4, 2002 to April 18, 2002.)

The United States Mint is committed to further improving its safety record. During the fourth quarter of FY 2002, the United States Mint retained the services of DuPont Safety Resources. This firm will conduct a benchmarking assessment of each United States Mint field facility, and then submit recommended safety improvements to the United States Mint during the first quarter of FY 2003.

1LTA rates are based upon the number of lost time accidents occurring per 200,000 work hours. All LTA rates cited in this report were based upon the actual number of hours worked by employees. (This method for calculating LTA rates is consistent with that used by all other Treasury bureaus.) By contrast, LTA rates cited in the United States Mint’s previous PEF reports were based upon the number of accidents that occurred per 200,000 hours of employment payment. Any discrepancy between LTA rates cited in this report and LTA rates cited in previous PEF reports is due to differing methods used for calculating work hours.

50 State Quarters Program

Launches: On August 8, 2002, United States Mint Director Henrietta Holsman Fore, joined by Indiana Governor O’Bannon, unveiled the new Indiana State Quarter at the International Motor Speedway near Indianapolis. The coin, which showcases the image of an “Indy” car and an outline of the state of Indiana, was the fourth State Quarter released in 2002 and the 19th State Quarter released since the 50 State Quarters Program began in 1999. The launch event for the Indiana State Quarter was attended by almost 3,000 people who exchanged a total of about $70,000 worth of paper money for Indiana Quarters. In addition, the event drew positive media attention from outlets across the nation. Indiana State Quarters, which are packaged in two-roll sets (40 coins per roll) and in bags of 100 and 1,000 coins, are available through the United States Mint’s popular subscription program. (To view the United States Mint’s subscription page, click on the “Subscriptions” button on the lower left corner at http://catalog.usmint.gov.)

On October 15, 2002, the Mississippi State Quarter will be released. Hosted by Director Fore and Mississippi Governor Musgrove, the launch event will be held on October 22 in Jackson, Mississippi.

Quarter Designs: By November 2002, the Secretary of the Treasury will have returned to the state Governors all of the final designs for the five State Quarters (Illinois, Alabama, Maine, Missouri and Arkansas) that are scheduled for release in 2003.

The current status of designs for the five 2003 State Quarters are as follows: Final designs for the Illinois, Alabama, Maine and Arkansas Quarters have been approved by the Secretary of the Treasury. The Secretary of the Treasury approved five candidate designs for the Missouri State Quarter on September 27, 2002.

In August/September 2002, each of the five states that will be honored by the release of State Quarters in 2004 (Michigan, Florida, Texas, Iowa and Wisconsin) submitted candidate designs to the United States Mint.

Historic Settlement of Case Against Washington Mint, LLC

On August 5, 2002, the United States Mint reached an unprecedented $2.1 million settlement with the Washington Mint, LLC, marking an end to three years of litigation and all pending copyright, trademark and false advertising claims. The Consent Decree also requires the Washington Mint, LLC to serve a consumer awareness notice to its customers of U.S. coins or U.S. coin replicas since January 1, 2000, in an effort to eliminate existing confusion over the Washington Mint’s status as a private business and to educate consumers on replica coin products. The Washington Mint, LLC remains subject to a permanent injunction, which prohibits it from producing and marketing replicas of the Golden Dollar coin, and requires it to use a court-ordered disclaimer in all advertisements and marketing materials featuring United States Mint-related products.

This historic settlement affirms the United States Mint’s commitment to protect and educate consumers across the nation and to safeguard its reputation for producing the highest quality coins and products.

New Partnerships

The United States Mint recently developed new partnerships with the United States Bureau of Engraving and Printing (BEP) and the United States Postal Service (USPS) that will help increase the visibility of Mint products and expand the Mint’s product offerings.

United States Postal Service: The United States Mint and USPS are currently jointly developing three new products that will be available in the Fall of 2002. Each of these products features one or more State Quarters from the United States Mint’s 50 State Quarters Program together with products from the USPS’s Greetings From America series, which honors each of the 50 states with its own postcard and stamp.

The new joint United States Mint/USPS products will be sold via the United States Mint and USPS websites, selected post offices, USPS product catalog and Mint retail locations. These products are:

- The Priority Proof Gift Set, which will package a 50 State Quarters Proof Set together with a set of the Greetings From America postcards and stamps from the same states. The Priority Proof Gift Set will be distributed in ready-to-mail priority mailers.

- The Collectors’ Cards, which will package a 50 State Quarters coin and a Greetings from America stamp from the same state. Collectors’ Cards will be sold individually and in packs of five.

- The 50 State Quarters/Greetings Stamp Portfolios, which will package a set of all five 50 State Quarters released during a single year together with Greetings From America stamps from the same year. A different 50 State Quarters/Greetings Stamp Portfolio will be assembled to represent each year since 1999, when the 50 State Quarters began.

Bureau of Engraving and Printing: Under a new agreement between the United States Mint and the BEP, the United States Mint is purchasing selected BEP products at bulk rates and then selling these products to the public via the Mint’s print and electronic catalogs. The United States Mint is providing customer service to purchasers of its BEP products and processing returns of them. The new agreement also obliges BEP to replace its damaged products and accept returns of unsold or damaged BEP products from the United States Mint, as necessary.

The first products sold under the new United States Mint/BEP partnership are uncut sheets of crisp, new $1.00, $2.00, and $5.00 bills. These products are featured in the United States Mint’s annual catalog, which was released on September 25, 2002.

Coin Redesign

Some members of the American public, Congress, and the coin collecting community have expressed interest in redesigning all of the Nation’s circulating coinage. The United States Mint recognizes that that any large-scale coin redesign effort would involve intensive collaboration with Congress, the American public and various experts. Should Congress endorse such an initiative, the United States Mint would be poised to facilitate its implementation. The United States Mint would look forward to coordinating the many processes that would be needed to select new designs for circulating coins, if Congress should approve such an initiative. In addition, the United States Mint is working with Congress on nickel redesign legislation.

During the fourth quarter of FY 2002, the House passed H.R. 4903, which is also known as “The Keep Monticello on the Nickel Act.”

Improvements In Coin Inventory Management

The Coin Efficiencies Workgroup, which is composed of members of the United States Mint and Federal Reserve, recently developed a new inventory management and forecasting tool. During the fourth quarter of 2002, this tool was used for the first time by the Federal Reserve to generate the monthly coin order that it submits to the United States Mint.

The new inventory management and forecasting tool works by synthesizing information on current Federal Reserve inventories, inventory targets and econometric forecasts of coin demand to generate a recommended monthly coin order for each Federal Reserve Bank and Branch Office. Each office reviews and adjusts the recommended order as needed based upon additional business information not available in the tool. These adjusted Bank and Branch orders are then aggregated to yield a total order for the Federal Reserve.

This new inventory management and forecasting tool also supports short-term coin demand forecasting by the Federal Reserve and production planning by the United States Mint. During FY 2003, the Coin Efficiencies Workgroup will monitor and further refine this tool’s accuracy.

During the fourth quarter of FY 2002, the Coin Efficiencies Workgroup began testing a new Extranet application that will give Federal Reserve offices access to real-time information on coin shipments scheduled by the United States Mint. This testing should be completed during the first quarter of FY 2003. Then, the application will be made available to all Federal Reserve offices.

Supply Chain Management

In July 2002, the United States Mint established a Supply Chain Management Workgroup to coordinate various initiatives aimed at developing a fully integrated supply chain for the Mint that incorporates best-in-business practices. All segments of the Mint’s supply chain — from materials supply to coin distribution — will be addressed. During FY 2003, the Supply Chain Management Workgroup will establish an Extranet application that will allow the United States Mint and its key suppliers to share information. The workgroup will also pursue initiatives to improve supplier partnerships, benchmark against industry leaders, streamline production planning for circulating coins, improve numismatic forecasting and production, and implement and improve software solutions. These projects will involve collaboration with the United States Mint’s supply partners, manufacturing facilities, and the Coin Efficiencies Workgroup.

E-Business Solution Project

The staff of the United States Mint’s e-Business Solution Project (eSP) is working to implement cutting-edge technologies that are enhancing the ability of the United States Mint — which is already one of the nation’s largest online retailers — to act as a customer-centered, market-responsive organization. During the fourth quarter of 2001, as part of its eSP efforts, the United States Mint launched a new online catalog, outsourced deliveries to a new pick-and-pack product distribution facility and implemented a new customer relationship management system that is integrated with order entry, order processing and inventory management systems. Since then, the United States Mint has shipped 7.7 million items to over 6 million customer orders and signed up over 56,000 customers for new subscriptions.

The United States Mint’s recent eSP upgrades have improved its customer service by reducing the Mint’s typical order fulfillment time from up to eight weeks to less than one week. These eSP upgrades are also enabling the Mint to automatically consolidate multiple orders from a single customer into a single package, supporting the Mint’s streamlined return procedures and supporting the establishment of an order status self-check function on the Mint’s online catalog. In addition, according to the results of a recent customer satisfaction survey conducted by Schulman, Ronca and Bucuvalas, Inc., 72 percent of the United States Mint’s customers believe that the Mint’s new online catalog is “somewhat” or “much better” than the online catalog that it replaced.

Auction of 1933 Double Eagle Gold Coin

On July 30, 2002, the United States Mint sold a much-publicized 1933 Double Eagle gold coin that will generate more than $3 million for the United States Treasury. The coin, auctioned by Sotheby’s in New York City during the American Numismatic Association’s annual convention, sold for $6.6 million to an anonymous bidder. An additional 15 percent auction fee brought the sales price to $7.59 million and an additional $20 was needed to “monetize” the face value of the coin so that it would be legal to own, bringing the final sales price to $7,590,020. It is believed to be the most ever paid for a coin at auction.

The United States Mint’s Public Enterprise Fund (PEF) received the entire amount. The PEF will disburse a portion to Sotheby’s to pay for the services it rendered to the United States Mint in marketing and auctioning the coin. In addition, the PEF will deduct the United States Mint’s expenses in administering the contract and protecting the coin. The PEF will then retain half the proceeds under an out-of-court settlement — expected to be slightly more than $3 million, which will be transferred to the United States Treasury as a miscellaneous receipt.

Fourth Quarter Audits

During the fourth quarter of FY 2002, the U.S. General Accounting Office (GAO) issued New Dollar Coin: Marketing Campaign Raised Public Awareness But Not Widespread Use (Report GAO-02-896). This report advised the United States Mint to suspend marketing and promotion of the Golden Dollar until the United States Mint completes further research into barriers to the Golden Dollar circulation and provides evidence that additional marketing and promotion efforts will increase Golden Dollar circulation. The United States Mint generally concurs with these recommendations. As explained in this PEF’s ‘Golden Dollar Activities” section, the United States Mint is currently researching barriers to Golden Dollar circulation, and plans to incorporate the results of its research into its revised Golden Dollar marketing plan.

During the fourth quarter of FY 2002, GAO also released one draft report covering United States Mint activities: Human Capital: Effective Use of Flexibilities Can Assist Agencies in Managing Their Workforces (Draft Report GAO-03-2). This draft report recognized the United States Mint’s implementation of effective human capital flexibilities, such as alternative work schedules, monetary and non-monetary incentive awards, the creation of a “human resources flexibilities team,” actively seeking employee input, and the revision of personnel-related policies and procedures, among others.

During the fourth quarter of FY 2002, GAO initiated the following studies covering United States Mint activities:

- A review of whether security at the United States Mint and the Bureau of Engraving & Printing, which each currently have their own security forces, should be handled by the same federal law enforcement agencies that currently handle security at other Treasury Department bureaus.

- An audit of the recruitment and retention procedures of the Federal Uniformed Police of the United States Mint, the Bureau of Engraving & Printing, and the United States Secret Service.

- An analysis of whether the United States Mint should purchase planchets of blanks for coin denominations besides the penny, rather than produce these planchets itself, as it currently does. This analysis will consider the cost and security implications of both alternatives.

- An analysis of the differences between the budgetary, accounting and oversight costs involved in the production of paper currency and coins, and the historical reasons for these differences.

In addition, the Treasury Office of the Inspector General (OIG) recently announced plans to initiate a Review Of The United States Mint’s Use of Government Purchase Cards. Through this analysis, the OIG will determine whether the United States Mint’s existing controls on government purchase cards are adequate to ensure that they are used for their intended purposes.

Golden Dollar Activities

During the fourth quarter of FY 2002, the United States Mint launched the Golden Dollar Research Program. Through this Research Program, the United States Mint will identify ways to overcome barriers to the distribution and use of Golden Dollar coins in everyday business transactions, such as coin operated industries, transit and retail operations. It will also measure consumer behavior and attitudes towards the Golden Dollar. Research results will become available during the first quarter of FY 2003.

Other Highlights

Future Commemorative Coin Programs

2003 First Flight Centennial Commemorative Coins: This series of gold, silver and clad coins will mark the 100th anniversary of the Wright Brothers’ historic flight at Kitty Hawk, North Carolina. Some of the proceeds from sales of these coins will help pay for the upkeep of the Wright Brothers Monument in North Carolina.

Prepared by the United States Mint, candidate designs for the First Flight Commemorative Coins were presented to the Citizens Commemorative Coin Advisory Committee on August 2, 2002, and then reviewed by the Commission of Fine Arts on September 19, 2002.

2004 Lewis and Clark Commemorative Coin: This coin will mark the 200th anniversary of the Lewis and Clark expedition. Prepared by the United States Mint, candidate designs for the Lewis and Clark Commemorative Coin were reviewed by the Citizens Commemorative Coin Advisory Committee on September 29, 2002. These candidate designs are tentatively scheduled to be presented to the Commission of Fine Arts in October 2002.

2004 Thomas A. Edison Silver Dollar: This coin will mark the 125th anniversary of Thomas Edison’s invention of the light bulb. The United States Mint is currently preparing preliminary design candidates for this coin.

Customer Care Center Relocation

To improve customer service and reduce costs, the United States Mint has reorganized its customer care activities. As part of this reorganization, in August 2002, the United States Mint moved its Customer Care Center (CCC) from Lanham, Maryland to the Mint’s Headquarters at 801 9th Street in Washington DC. This move will save the United States Mint about $576,000 annually (about $48,000 monthly) in rent.

According to a preliminary analysis, the total cost of moving the CCC from Lanham, Maryland, to Washington, DC, was about $460,000 — only about 26 percent of the projected cost of about $1,737,000, which had been calculated using typical government costing procedures. The United States Mint achieved these savings by negotiating firm fixed-price contracts with movers, and by using other innovative project management techniques.

ANA Convention

The United States Mint played a prominent role at the American Numismatic Association’s annual convention, which was held in New York City from July 31 to August 4, 2002. Director Fore helped open the convention, which drew more than 11,000 attendees. She also participated in her first meetings of the Mint Directors Conference (MDC) as this organization’s Vice President, and led several MDC meetings, including a general assembly. (The MDC is an international body that exchanges manufacturing, technical and financial information of common interests among its membership of 42 national Mints.) Attendees at the MDC meetings discussed various research issues, planned for the XXIII biennial MDC convention, which will be hosted by the United States Mint in San Francisco from March 20 to 23, 2004, and voted on issues concerning the Coin Registrar Office. (The Coin Registrar Office houses data on the coin specifications of member nations.)

Director Fore also attended meetings of the International Mint Market Development Council (IMMDC). (The IMMDC is a group of national mints that promote international interest and education in numismatics.) Discussions at the IMMDC meetings focused on strategies for marketing coins on the Internet, manufacturing innovations and administrative options facing the IMMDC.

Director Fore also conducted a forum to gather input from coin collectors and eight of the largest international dealers from six countries on how to better serve their needs, prospects for developing future partnerships and trends in sales of United States Mint products. In addition, throngs of coin collectors flocked to the United States Mint’s conference booth, where they met Director Fore and purchased a total of $70,000 worth of United States Mint products.

Biennial Convention of the International Mint Directors’ Conference

According to the rules of the Mint Directors Conference (MDC), the director of the mint hosting the MDC’s biennial convention automatically assumes the position of Vice President of the MDC. As Vice President of the MDC, Director Fore’s responsibilities include helping the MDC President direct the MDC, reviewing and approving all correspondence between the MDC Council and MDC Members, and organizing the biennial convention, which is expected to draw 500 to 600 individuals, including representatives of national Mints, dealers and industrial and marketing observers.

Preparations for the MDC’s XXIII Convention are progressing via weekly meetings of the United States Mint’s planning team. The United States Mint is also working closely with the event planning staff of the Department of Justice’s Mail, Multimedia & Publications Services, which has been contracted to provide services to organize the Conference.

Citizen Commemorative Coin Advisory Committee

In August 2002, Treasury Secretary Paul O’Neill appointed two new members to the Citizens Commemorative Coin Advisory Committee (CCCAC), an organization that reviews proposed coin designs and identifies people, places or events that should be honored by Congress with commemorative coins. One new CCCAC members is Ms. Ute Wartenberg — Executive Director of the American Numismatic Society, former Assistant Director of the American Numismatic Society and Assistant Keeper of the British Museum (Curator of Greek Coins). Another new CCCAC member is Ms. Connie Matsui — National President of the Girl Scouts of the United States of America and Senior Vice President of the IDEC Pharmaceuticals Corporation. In September 2002, Ms. Wartenberg and Ms. Matsui attended the CCCAC business meeting in Washington, DC.

50 State Quarters & Euro Collection

On June 12, 2002, the United States Mint released the 50 State Quarters & Euro Collection, which will be limited to 100,000 sets. Each set includes each of the five State Quarters released in 2002 and one euro from each of the 12 European Union nations that adopted the euro in 2002. When the 50 State Quarters & Euro Coin Collection was released, the United States Mint limited each order to 20 sets per order to ensure that the United States Mint’s inventory would be sufficient to allow all interested consumers to purchase sets. The United States Mint recently lifted that limit in order to allow consumers to order unlimited numbers of remaining sets

Strengthened Policy on Use of Government Travel Cards

The United States Mint has continued to strengthen its policies on non-payment and misuse of credit cards for government travel issued under the Government Travel Card Program contract by Citibank. Every month, the Mint’s Travel Manager reviews all Mint employees’ Citibank statements for delinquencies and misuses. Whenever a delinquency or misuse is identified through these reviews, the violating employee is sent a memo informing him or her of the violation; a copy of each memo is also sent to the violating employee’s supervisors.

Within ten days of an employee’s receipt of a memo identifying a credit card violation, corrective action must be taken. If this ten-day deadline is missed, the Mint’s Chief Financial Officer may take disciplinary action against the violating employee’s supervisor and against the violating employee.

New Section in Annual Report

The United States Mint added a new section to its FY 2001 Annual Report. This new section features photographs of all circulating coins, numismatic products and American Eagle Bullion Coins that were produced, marketed or sold by the United States Mint during FY 2001. It also includes coin specifications for numismatic products and American Eagle Bullion Coins, as well as tables of the numbers of circulating coins, numismatic products and American Eagle Bullion Coins issued and minted during FY 2000 and FY 2001.

Medals

On September 19, 2002, in the Capitol Rotunda, Speaker of the House Dennis Hastert presented General Henry H. Shelton with the Congressional Gold Medal.

New Chief Information Officer

In August 2002, Mr. Jerry Horton joined the United States Mint as Chief Information Officer. Mr. Horton has over 15 years of Information Technology experience, and his previous positions include Vice President and Director of several “eBusiness,” manufacturing startups and large corporations.

Tours in Philadelphia and Denver

On September 6, 2002, the Philadelphia Mint resumed public tours for school and youth groups, military and veterans groups and Congressionally sponsored groups of six or fewer people. The Denver Mint had resumed tours on the same limited basis in June, 2002. Tours of the Denver and Philadelphia Mints were suspended following the attacks of September 11, 2001.

Competitive Sourcing

A key component of President George W. Bush’s Management Agenda is a competitive sourcing initiative that requires federal agencies to compare their in-house costs of performing non-inherently governmental functions against private sector costs of performing the same functions. The United States Mint is complying with this initiative by conducting two studies of complex and operationally critical functions; one study focuses on selected Office of Human Resource functions and the other focuses on Customer Care Center functions. In 2003, the United States Mint will begin additional studies.

Educational Web Site

The United States Mint’s educational web site — which is called the History In Your Pocket (H.I.P.) Pocket Change — broadcasts games, stories and other engaging activities that are designed to inspire an interest in coin collecting among children. The site also broadcasts lesson plans and other educational resources for teachers. Since its launch in July 1999, the site has drawn increasingly heavier traffic. For example, while the site received 373,909 hits during the second half of FY 2001, it received 433,523 hits during the second half of FY 2002 — an increase of 16%.

The United States Mint Museum and Visitor Center

Washington, DC’s Downtown Development District requires commercial real estate properties to devote at least 50 percent of their street-level space to preferred retail and art uses. The United States Mint remains committed to satisfying this requirement by opening a United States Mint Museum and Visitor Center on the street level of its Headquarters at 801 9th Street in Washington, DC. However, except for a possible project that would provide access from the area to restrooms already located on the same floor, construction on the Mint Museum and Visitor Center currently remains suspended, pending Congressional approval of additional work.

In addition, the United States Mint is currently seeking a vendor to create a street-level window display at Headquarters that would market the Mint’s web site and commemorative coins. The United States Mint is also considering installing cabinets displaying current Mint products in the lobby and rotunda of the Headquarters building.

A Look Ahead

New Mint Deputy Director

David A. Lebryk, Deputy Assistant Secretary for Fiscal Operations and Policy at the Treasury Department, joined the United States Mint as Deputy Director on October 6.

Before joining Fiscal Operations and Policy at the Treasury Department in 1997, Mr. Lebryk served as Acting Deputy Assistant Secretary for Human Resources. Between 1995 and 1996, he was responsible for a public education campaign introducing the newly designed Series 1996 currency. He also previously served as a Special Assistant to the Deputy Secretary and the Under Secretary for Domestic Finance. He joined the Treasury Department in 1989 as a Presidential Management Intern in the Office of the Assistant Secretary for Policy Management and Counselor to the Secretary.

Mr. Lebryk holds a Master of Public Administration from the John F. Kennedy School of Government, and a Bachelor of Arts degree in Economics from Harvard College.