In a conference report to Public Law 104-52 that created the United States Mint Public Enterprise Fund (PEF), Congress directed the United States Mint to report quarterly on implementation of the PEF. This report is designed to fulfill that requirement.

Contents

- Third Quarter Fiscal Year (FY) 2007 Financials:

- Year-to-Date Comparison: Year-to-date revenues for the third quarter FY 2007 were 21% higher than year-to-date revenues for the third quarter FY 2006.

- Third Quarter Comparison: Revenues for the third quarter of FY 2007 were 10% higher than revenues for the third quarter of FY 2006.

- Comparison to Previous Quarter: Revenues for the third quarter of FY 2007 were 4% lower than revenues for the second quarter of FY 2007.

- On May 17, 2007, the United States Mint introduced the second Presidential $1 Coin, the John Adams Presidential $1 Coin, in Quincy, Massachusetts. Director Ed Moy and descendants of John Adams hosted the event in the former President’s home town, while an Adams re-enactor greeted school children.

- On June 19, 2007, the First Spouse Gold Coin Program was introduced, featuring the first two coins in the series, the Martha Washington and the Abigail Adams First Spouse $10 Gold Coins.

- The Washington and Idaho commemorative quarter-dollar coins were released into circulation.

- On June 26, 2007, the Byron Nelson Congressional Gold Medal was awarded posthumously to his widow in a presentation ceremony on Capitol Hill.

Other Highlights

In May, the final designs for the Norman E. Borlaug Congressional Gold Medal were approved by the Secretary of the Treasury.

State of the United States Mint

The United States Mint’s primary responsibilities are:

- Producing an adequate volume of circulating coins for the United States to conduct its trade and commerce, and distributing these circulating coins to the Federal Reserve Bank;

- Striking national medals, including Congressional Gold Medals;

- Manufacturing, marketing and selling proof and uncirculated coins, commemorative coins and medals to the general public. These products are known as numismatic products. Their value generally depends on factors such as mintage, rarity, condition and age;

- Manufacturing, marketing and selling gold, silver and platinum bullion coins through the American Eagle and the American Buffalo Bullion Programs. The value of these bullion coins generally depends on their weight in specific precious metals. These products are not sold directly to the general public by the United States Mint. They are sold to Authorized Purchasers and are available to the general public through precious metal dealers, coin dealers, brokerage companies and participating banks;

- Safeguarding United States Mint assets and non-Mint assets that are in the United States Mint’s custody, including bullion reserves at the Fort Knox Bullion Depository.

Status of the Public Enterprise Fund

The United States Mint’s Public Enterprise Fund is financed by the sale of circulating coins to the Federal Reserve and the sale of numismatic and bullion coins and other products to customers worldwide.

Year-to-Date Comparison

Table #1

Comparison of Year-to-Date Revenues for 3rd Quarter 2007 to 3rd Quarter 2006

(Millions of Dollars)

| Product Category | Year-to-Date through 3rd Qtr FY 2007 | Year-to-Date through 3rd Qtr FY 2006 | Change |

|---|---|---|---|

| Circulating | $1337 | $968 | +38% |

| Numismatic | $384 | $287 | +34% |

| Bullion* | $272 | $389 | -30% |

| Total | $1993 | $1644 | +21% |

*Investment versions; proof versions are included in numismatic sales.

Year-to-Date Circulating Collections: Year-to-date circulating collections through the third quarter of FY 2007 totaled $1,337 million — up 38% from the same period of FY 2006. (See Table #1) This increase is attributable, in large part, to an increase in orders from the Federal Reserve Bank resulting from the introduction of the Presidential $1 Coin.

The United States Mint’s circulating collections fluctuate because variations in the United States economy change demand for circulating coins by commercial establishments and the general public. To accommodate such demand changes, the United States Mint and the Federal Reserve Bank continually assess their inventories and the demand for circulating coins, and then adjust their production, ordering and delivery schedules accordingly.

Year-to-Date Numismatic Revenues: Year-to-date numismatic revenues through the third quarter of FY 2007 totaled $384 million — up by 34% from the same period of FY 2006. (See Table #1) This increase resulted from sales of 2006 products. These products include the American Eagle Anniversary Sets (American Eagle 20th Anniversary Gold & Silver Set, American Eagle 20th Anniversary Silver Coin Set and American Eagle 20th Anniversary Gold Coin Set) and the San Francisco Old Mint Commemorative Coin Program, which included a gold option.

Year-to-Date Bullion Revenues: Year-to-date bullion revenues through the third quarter of FY 2007 totaled $272 million — down by 30% from the same period of FY 2006. (See Table #1) This decrease was attributed to two factors: 1) in the third quarter of FY 2007, we experienced a decrease in orders because of the increase in precious metals prices, and 2) the third quarter of FY 2006 revenue was unusually high because of the launch of the 2006 24-Karat American Buffalo Gold Bullion Coins.

Third Quarter Comparison: FY 2007 to FY 2006

Table #2

Comparison of 3rd Quarter FY 2007 Revenues to 3rd Quarter FY 2006 Revenues

(Millions of Dollars)

| Product Category | 3rd Qtr FY 2007 | 3rd Qtr FY 2006 | Change |

|---|---|---|---|

| Circulating | $552 | $352 | +57% |

| Numismatic | $104 | $135 | -23% |

| Bullion* | $50 | $153 | -67% |

| Total | $706 | $640 | +10% |

*Investment versions; proof versions are included in numismatic sales.

Circulating Third Quarter Comparison: Circulating collections for the third quarter of FY 2007 totaled $552 million — up by 57% from the same quarter of FY 2006. (See Table #2) This increase reflected an increase in the Federal Reserve Bank’s coin order—most notably orders for the new Presidential $1 Coin.

Numismatic Fiscal Year Comparison: Numismatic revenues for the third quarter of FY 2007 totaled $104 million — down by 23% from the same quarter of FY 2006. (See Table #2) This revenue decrease resulted from the later release of some annual sets and precious metal products in 2007 compared to 2006, including the annual United States Mint Proof Set, the annual United States Mint Uncirculated Coin Set and the American Eagle Platinum Proof Coin Program. These are all scheduled to be introduced in the fourth quarter of FY 2007.

Bullion Fiscal Year Comparison: Bullion revenues for the third quarter of FY 2007 totaled $50 million — down by 67% from the same quarter of FY 2006. (See Table #2) This decrease was attributed to two factors: 1) in the third quarter of FY 2007, we experienced a decrease in orders because of the increase in precious metals prices, and 2) in the third quarter of FY 2006, revenue was unusually high because of the launch of the 2006 24-Karat American Buffalo Gold Bullion Coins.

Comparison to Previous Quarter

Table #3

Comparison of 3rd Quarter FY 2007 Revenues to 2nd Quarter FY 2007 Revenues

(Millions of Dollars)

| Product Category | 3rd Qtr FY 2007 | 2nd Qtr FY 2007 | Change |

|---|---|---|---|

| Circulating | $552 | $537 | +3% |

| Numismatic | $104 | $116 | -10% |

| Bullion* | $50 | $166 | -70% |

| Total | $706 | $819 | +14% |

*Investment versions; proof versions are included in numismatic sales.

Quarterly Circulating Comparison: Circulating collections for the third quarter of FY 2007 totaled $552 million — up by 3% from the second quarter of FY 2007. (See Table #3) This collection’s increase is consistent with the United States Mint’s shipment of 4.9 billion coins to the Federal Reserve Bank during the third quarter of FY 2007 — up by 40% from the 3.5 billion coins shipped during the second quarter of FY 2007.

Projected Fourth Quarter 2007 Circulating Collections: Circulating collections are expected to decrease next quarter in conjunction with a decrease of the Federal Reserve’s forecasted coin order to 3.2 billion coins because of normal seasonal increases to Federal Reserve inventory.

Quarterly Numismatic Comparison: Numismatic revenues for the third quarter of FY 2007 totaled $104 million — down by 10% from the second quarter of FY 2007. (See Table #3) This slight revenue decrease resulted from the later than expected release of some 2007-dated products.

Projected Fourth Quarter Numismatic Revenues: Next quarter’s revenues are expected to increase because the United States Mint will be releasing more 2007-dated products, including annual sets and precious metal products such as the American Eagle Platinum Proof Coins, as well as shipping many products sold in the third quarter that will not book revenue until the fourth quarter.

Quarterly Bullion Comparison: Bullion revenues for the third quarter of FY 2007 totaled $50 million — down by 70% from the second quarter of FY 2007. (See Table #3) This revenue decrease was a result of the normal seasonal decline in bullion orders, as well as the increase in precious metals prices.

Projected Fourth Quarter 2007 Bullion Revenues: Bullion revenues are expected to remain the same next quarter as a result of the normal seasonal decline in bullion orders, as well as the increase in precious metals prices.

Update on Activities

50 State Quarters Program

Washington Quarter Launch

United States Mint Director Ed Moy joined Washington Governor Chris Gregoire and First Gentleman Mike Gregoire to launch the Washington commemorative quarter-dollar in a ceremony on April 11, 2007, at the Fisher Pavilion in Seattle, Washington. Christine Chen, host of About the Money with Christine Chen, was the Master of Ceremonies.

The Washington quarter was the second coin of 2007, and the 42nd to be introduced in the United States Mint’s 50 State Quarters Program. The reverse of Washington’s quarter features a king salmon breaching the water in front of majestic Mount Rainier. The coin bears the inscriptions “The Evergreen State,” “Washington” and “1889.”

Idaho Quarter

The Idaho quarter, the third coin of 2007, and the 43rd to be introduced in the United States Mint’s 50 State Quarters Program went into circulation on June 4, 2007. The launch is scheduled for August 3, 2007.

50 State Quarters Coin Design Process

On May 25, 2007, the Secretary of the Treasury approved the final designs for the states to be honored in 2008: Oklahoma, New Mexico, Arizona, Alaska and Hawaii.

Presidential $1 Coin Act of 2005

John Adams Presidential $1 Coin Launch

The John Adams Presidential $1 Coin introduction and coin exchange was held in Quincy, Massachusetts, onMay 22, 2007. This is the second coin to be released in the Presidential $1 Coin Program. The United States Mint coordinated with civic and business organizations in Quincy and descendants of John Adams to encourage Presidential $1 Coin orders and circulation by hanging lamp post banners displaying the John Adams Presidential $1 Coin for two weeks. The United States Mint also coordinated with local businesses to showcase circulation opportunities by exchanging goods for John Adams Presidential $1 Coins.

2007 Presidential $1 Coin Proof Set™

The 2007 Presidential $1 Coin Proof Set went on sale June 21, 2007, with 616,056 sets sold through June 30, 2007, generating $9,210,037 in revenue.

Presidential $1 Coin Outreach

This quarter, to promote the Presidential $1 Coin Program, the United States Mint made a presentation at the American Bankers Association meeting and attended the National Automated Merchandising Association (NAMA) Convention, where more than 5,000 people, including more than 700 buyers and vending operating companies, were in attendance. Additionally, NAMA had agreed, and made prior arrangements with up to 10 machine manufacturers who were exhibiting at the event, to demonstrate the use of Presidential $1 Coins in their vending machines. The United States Mint also participated in the National Bulk Vendors Association Convention, the National Retail Association (NRA) Annual Convention, the Food Marketing Institute (FMI) show, and the American Public Transportation Association Fare Collection Workshop.

To promote the use of the Presidential $1 Coins, the United States Mint assisted regional Wal-Mart promotions, reached out to Presidential Libraries to encourage gift shops and admissions desks to dispense Presidential $1 Coins, and provided media and other support for Presidential $1 Coin promotions by Harvest Foods.

First Spouse 24-Karat Gold Coins

The United States Mint is honoring our Nation’s First Spouses by issuing one-half ounce, 24-karat gold coins featuring their images in the order that they served as First Spouse. The Martha Washington and Abigail Adams Gold Coins went on sale June 19, 2007, and sold out in just over two hours. The Jefferson Liberty Gold Coin will be released next quarter.

First Spouse Design Process

On May 29, 2007, the Secretary of the Treasury approved the final designs for the 2008 First Spouse Gold Coin and Medal Program, honoring Elizabeth Monroe, Louisa Adams, President Andrew Jackson’s Liberty, and President Martin Van Buren’s Liberty.

The United States Mint has been in consultation with the White House Historical Association (WHHA) for the names of scholars and historians with expertise on the spouses to be honored in 2009. The design narratives are scheduled to be reviewed by the historians in July before being presented to the Citizens Coin Advisory Committee (CCAC).

American Buffalo 24-Karat Gold Coins

This quarter, 16,500 ounces of American Buffalo 24-Karat Gold Bullion Coins were sold. The American Buffalo 24-Karat Gold Proof Coins went on sale May 23, 2007, and at the end of the quarter, approximately 20,000 coins had been sold.

Artistic Infusion Program

In late May, the Artistic Infusion Program (AIP) Master Designers, Associate Designers, and Student Designers were assigned to develop reverse designs for the four 2009 Lincoln one-cent coins. This was the first assignment for the new Associate and Student Designers who joined the AIP this year.

The four Student Designers also participated in the first AIP Student Internship at the United States Mint at Philadelphia. During the three-week internship, the students learned to design, model, and cast a portrait under the supervision of the Senior Engraver and the team of sculptor-engravers. They also attended two field trips, one to the Metropolitan Museum of Art in New York, New York, and the other to the National Portrait Gallery and the National Gallery of Art in Washington, DC. Because all four students passed the internship, they are all eligible to receive college credit at their respective institutions of higher learning.

United States Mint Educational Initiative

Educational content was added to the United States Mint H.I.P. Pocket Change™ Web site, including Time Machine. The interactive cartoon was updated with a trip to the Great Depression era. An issue of the quarterly online newsletter, Making Cents, was added, as was a “State Quarter Day in the Classroom” page for Washington.

A Memorial Day page was created, as well as Summer Fun with Coins, Financial Literacy Month and National Coin Week pages. The “Coin of the Month” section featured the Washington quarter-dollar, the John Adams Presidential $1 Coin and the 1915 Panama-Pacific 50-Dollar Coin.

The United States Mint H.I.P. Pocket Change Web site had approximately one million visits during the quarter, an increase of 15% over the same quarter last year. In addition, 22,029 Westward Journey Nickel Series™ lesson plans, 180,043 of the 50 State Quarters lesson plans and 9,850 Presidential $1 Coin lesson plans were downloaded during this quarter.

In June, the United States Mint Educational Initiative (MEI) team staffed booths at the American Library Association and the National Education Association conferences. Both conferences attracted more than 35,000 educators and librarians, and more than 1,200 signed up for the Teachers’ Network.

Other Highlights

Commemorative Coin Programs

Jamestown 400th Anniversary Commemorative Coins (2007)

The Jamestown 400th Anniversary Commemorative Coin Program initially began sales in the 2nd quarter of FY 2007 with both silver and gold coins options. As of June 30, 2007, approximately 282,000 silver coins and 59,000 gold coins were sold.

Little Rock Central High School Desegregation 50th Anniversary Coin Program (2007)

The Little Rock Central High School Desegregation 50th Anniversary Silver Dollar was introduced on May 15, 2007. Product options include individual proof coins and individual uncirculated coins, as well as the Little Rock Coin and Medal set, which contains the uncirculated silver dollar and a bronze replica of the Congressional Gold Medal presented to the Little Rock Nine. The coin and medal set is limited to 25,000 units. As of this quarter, the total number of silver coins sold is 139,515. Of those sales, 22,464 are from the coin and medal sets.

American Bald Eagle Recovery and National Emblem Commemorative Coin Program (2008)

The design candidates were presented to the Federal advisory bodies in May, and the recommended final designs were sent to the Secretary of the Treasury for final approval on June 13, 2007. This is a three-coin program, including a $5 gold coin, a silver dollar and a clad half-dollar.

Abraham Lincoln Bicentennial One-Cent Coin and the Abraham Lincoln Commemorative Coin Program (2009)

The United States Mint has continued discussions with the Program Director of the Abraham Lincoln Bicentennial Commission to finalize the design themes for the obverse and reverse silver commemorative coin. Design development should begin in July 2007.

Four reverse designs are in development for the 2009 Abraham Lincoln Bicentennial One-Cent Coin. Designs are expected to be sent to the recipient organization and the Federal advisory bodies next quarter.

Louis Braille Commemorative Coin Program (2009)

The United States Mint has continued discussions with representatives of the National Federation of the Blind to finalize the design themes for the obverse and reverse of the silver commemorative coin.

Medals

2007 Byron Nelson Congressional Gold Medal

Public Law 109-357 authorizes the Department of the Treasury to produce a Congressional Gold Medal to be awarded posthumously to Byron Nelson in recognition of Mr. Nelson’s significant contributions to the game of golf as a player, a teacher and commentator. The Byron Nelson Congressional Gold Medal was awarded posthumously to his widow in a ceremony on June 26, 2007. Duplicate bronze medals of the Congressional Gold Medal went on sale on April 26, 2007.

2007 First Spouse Medals – Martha Washington & Abigail Adams

Public Law 109-145 authorizes the Department of the Treasury to produce and sell bronze duplicate medals of the 24-Karat First Spouse Gold Coins. The Martha Washington and Abigail Adams bronze medals went on sale on June 19, 2007, and will be followed later in the year by Jefferson’s Liberty and Dolley Madison bronzes.

Norman E. Borlaug Congressional Gold Medal

On May 1, 2007, the Secretary of the Treasury approved the final designs for the Congressional Gold Medal honoring Dr. Norman E. Borlaug.

Dalai Lama Congressional Gold Medal

The design candidates for the Dalai Lama Congressional Gold Medal were presented to the Federal advisory bodies in May, and the recommended final designs were sent to the Secretary of the Treasury for final approval on June 13, 2007.

Public Information Site

Several areas of the United States Mint’s public information website were updated to support the agency’s products and programs. For example, on June 21st a Circulating Coins section was added to incorporate all of the coins that the United States Mint produces for everyday commerce. The new Circulating Coins section already ranks as one of the more popular pages in the Coins and Medals section, as more than 30,000 people have visited those pages.

On May 25, hyperlinks were inserted on several Coins and Medals pages of the public information site that could take the site visitor directly to the catalog for specific products. Since the addition of the hyperlinks, more than 90,000 people have accessed those hyperlinks to gain access into the United States Mint Online Catalog. This was a direct result, uncovered in website usability testing, of satisfying customers’ desire to have more direct access to certain products.

Two new consumer issues were added to the Hot Items page under the Consumer Awareness section, which was renamed Consumer Alerts to better describe the content of the section. As a result of the name change, that section of the site has experienced a 30% increase in visits, and the average time spent on the pages has increased 13%.

The Presidential $1 Coin e-newsletter was sent out to more than 72,402 subscribers, and the Coins Online e-newsletter was sent out monthly to its more than 400,000 subscribers. In addition, the RSS (Really Simple Syndication) feed for the Product Information and Updates was the third most used section of the site. RSS feeds were just incorporated into the website at the beginning of this year and have proven to be a major vehicle for dispensing information to our visitors and customers.

The main site had 8,885,844 visits during the quarter, an increase of 32% over the same quarter last year. The average duration of a visit to the United States Mint website has gone up 182% in this quarter, compared to the same quarter last year, from 5:13 minutes to 14:43 minutes. This is attributed to the ongoing updates to current content and the creation of new content and features to the website.

Quality

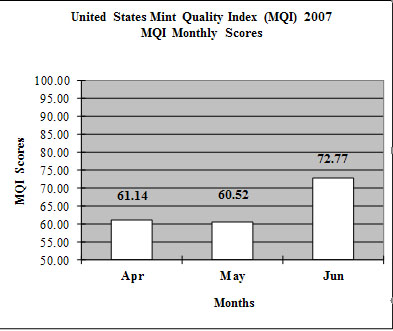

The United States Mint conducts periodic product quality audits at its manufacturing facilities with a cross- functional team composed of production, quality, and administrative personnel. A statistically significant sampling of coin products is evaluated, and the number of “defects” found is entered into a weighted index formula. The objective of the United States Mint Quality Index (MQI) is to measure relative quality levels and detect changes and trends in quality; it does not represent a “percent of good products.” The MQI is a viable metric for continual quality improvement at the United States Mint.

Safety

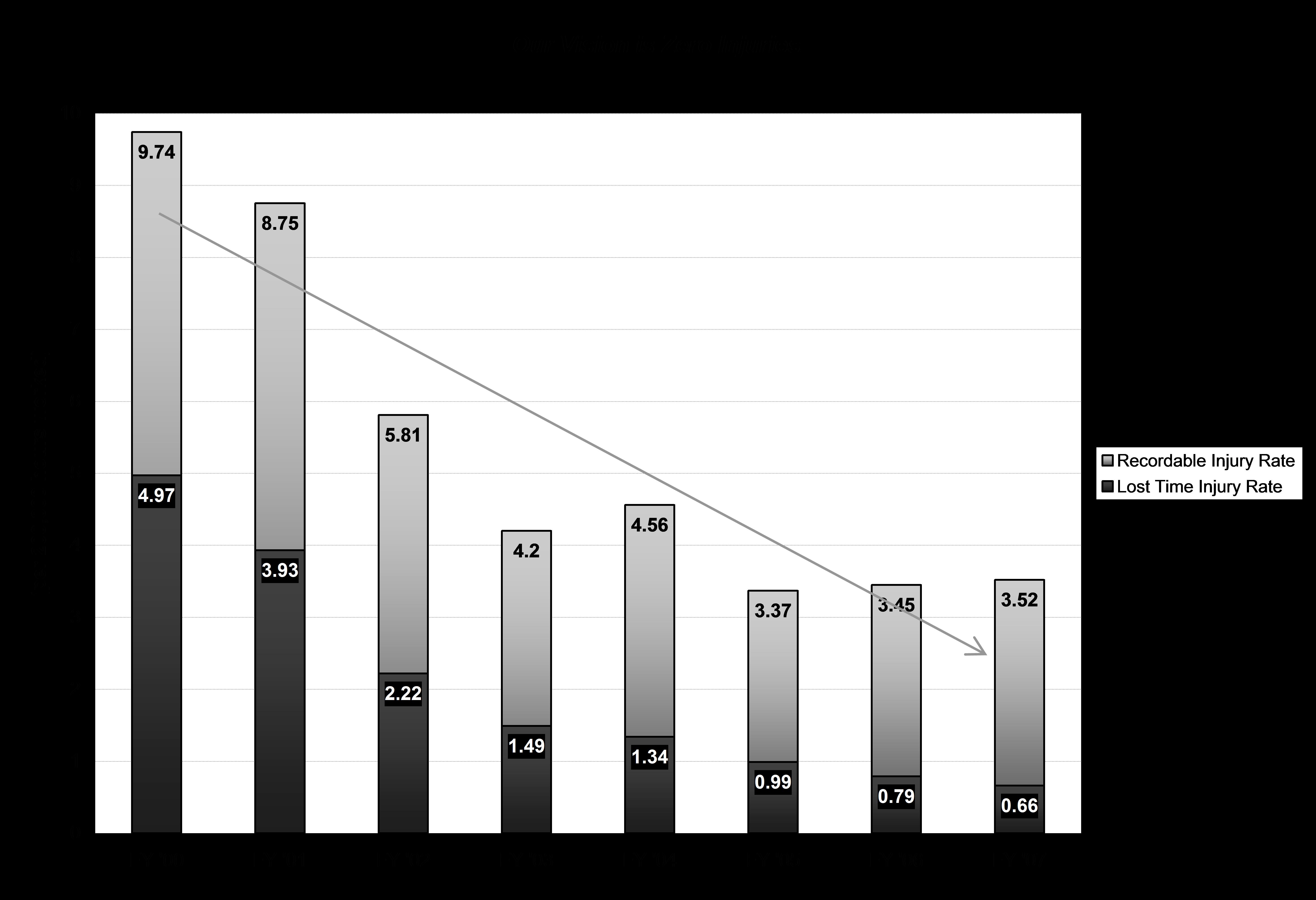

The Lost Time Injury Rate (the number of work-related injuries and illnesses that result in one or more lost work days per 200,000 hours worked) was 0.66 through the third quarter of FY 2007. This is a 16% reduction over FY 2006, and puts us within striking distance of achieving our strategic plan goal for 2007 of 0.62. The Recordable Injury Rate, which covers all injuries and illnesses, increased to 3.52 through the third quarter of FY 2007. This constitutes a 2% increase over FY 2006.

Audits and Reports

The Treasury Office of Inspector General (OIG) concluded a corrective action verification (CAV) as a follow-up to a previous FY 2004 audit on purchase cards, OIG Report number OIG-04-029, “Control Weaknesses and Poor Management Oversight in the United States Mint’s Purchase Card Program.” On April 5, 2007, the OIG issued the final version of the report “MANUFACTURING OPERATIONS: The Mint Has Taken Action to Improve Its Purchase Card Program (Corrective Action Verification on OIG-04-029).” The OIG validated that the corrective actions taken by the United States Mint corrected the previously reported conditions. The CAV is now closed.

The Government Accountability Office (GAO) initiated an engagement at the United States Mint to assess patterns of coin production, distribution and circulation from FY 2002 through 2006. The assessment was requested by the House Subcommittee on Domestic and International Monetary Policy, Trade, and Technology, Committee on Financial Services. An entrance conference was held on April 25, 2007, and discussions are ongoing between GAO and the United States Mint.